Introduction of Functions

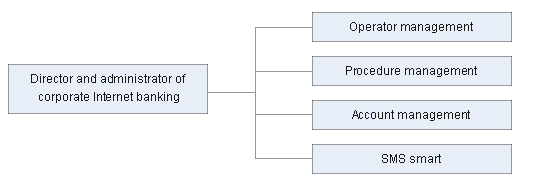

Director and administrator of corporate Internet banking: provide corporate client with individual business management and operation management setting.

●Operator management: provide standardized operator management mechanism to manage operator and its authority

●Flow management: provide diversified business flow program, and allow companies to set operation flow flexibly.

●Account management: provide personalized account authority management to set authorities of various accounts individually.

●SMS smart: provide notification service such as "smart messenger", "smart secretary" and "smart bodyguard"

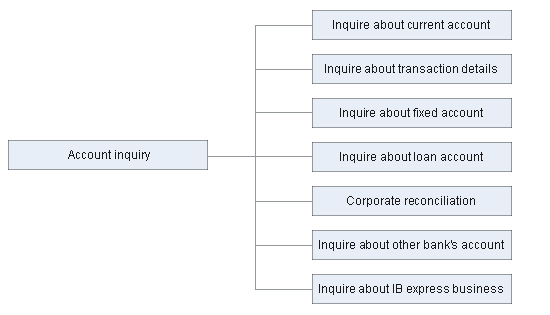

Account inquiry: provide corporate clients with complete inquiry service of local and foreign currency account

●Inquire about current account: real time inquire about the balance of local and foreign currency current account

● Inquire about transaction details: inquire about the transaction details of current local and foreign currency account

●Inquire about fixed account: inquire about the details of all fixed accounts

●Inquire about loan account: inquire about the details of all loan accounts

● Corporate reconciliation: provide online reconciliation between bank and enterprises concerning balance and transaction details

● Inquire about other bank's account: Inquire about the balance and transaction details of other bank's registered account

● Inquire about IB express business: inquire about the accounting for merchants of IB express

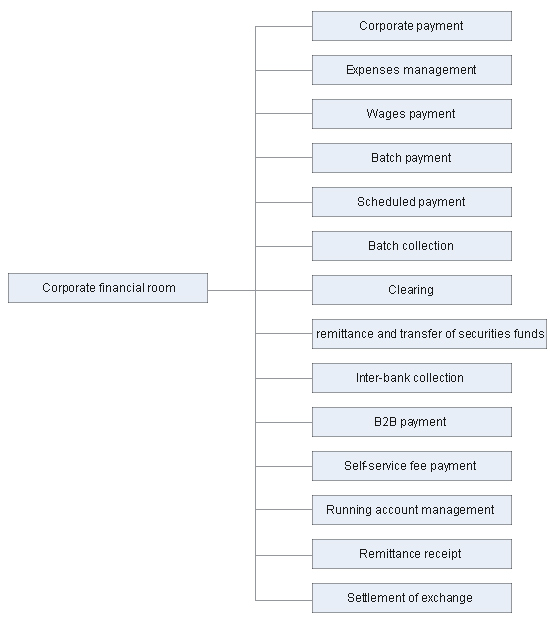

Corporate financial room: provide corporate clients with people-oriented functions such as corporate payment, expenses management, paying out wages, batch orders, scheduled payment, clearing, remittance and transfer of securities funds, batch collection, self-service fee payment, inter-bank collection, B2B payment, remittance receipt and settlement of exchange.

●Corporate payment: outbound and internal transfer

●Expenses management: corporates can pay current expense to account of IB or other bank, such as travel expense.

●Paying out wages: corporates can pay out wages to employee owning personal account at IB

●Batch payment: corporate can pay and manage expenses in batch.

●Scheduled payment: make payment, manage expenses or transfer internally at scheduled frequency and amount.

●Batch collection: collect payment from payers in batch on Internet banking.

●Self-service fee payment: inquire about fees to be paid and pay fees online by self-service

● Clearing, remittance and transfer of securities funds: securities companies and other settlement parties can conduct fund remittance and transfer between clients' account and excessive reserve account, capital verification account at CSDC and special offering account offline.

●Inter-bank collection: real time collection from other banks' registered account.

●B2B payment: generate, cancel and inquire about B2B payment direction, as well as for inquiring about the details on refunding of B2B order.

● Current account management: information management for corporate collector and private collector.

● Remittance receipt: print online remittance receipt.

● Settlement of exchange: self-service settlement of exchange

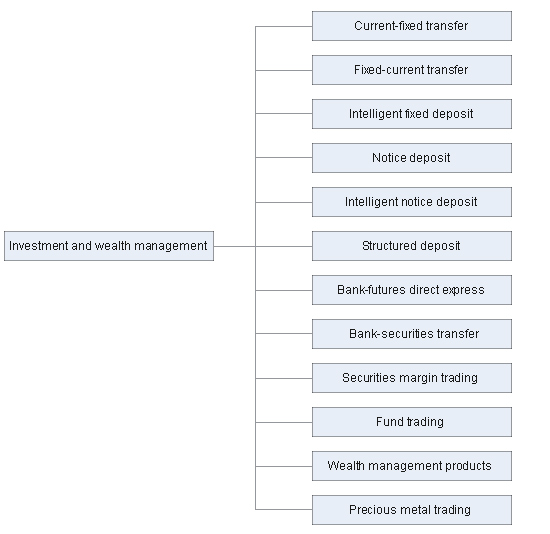

Investment and wealth management: provide corporate clients with functions such as fixed-current transfer, bank-securities transfer, margin trading, precious metal trading, fund trading, intelligent notice deposit, intelligent fixed deposit, investment on wealth management product etc.

●Fixed-current transfer: transfer between current deposit and fixed deposit, and between current deposit and notice deposit.

● Intelligent notice deposit: transfer the capital from the current accounts of corporate clients into notice deposit as agreed, and calculate the accumulative interest at the rate of seven-day deposit if the deposit term reaches seven days, or calculate the interest at the rate of one-day notice deposit if it fails to reach seven days.

●Intelligent fixed deposit: Clients set no deposit term at the beginning, and it is possible to withdraw in multiple times. Interest will be calculated according to rules specified in agreement and actual deposit term upon withdrawal.

● Bank-securities transfer: bank-securities transfer under third party depository of securities settlement funds

● Margin trading: margin trading under third party depository of securities settlement funds

●Bank-futures direct express: sign agreement online and transfer between bank and futures for bank-futures business

●Fund trading: account opening, subscription, purchase, redemption and inquiry of fund

●Wealth management product investment: Subscription, purchase, redemption and inquiry of online wealth management product

●Precious metal trading: information inquiry, market inquiry and transaction declaration of precious metal

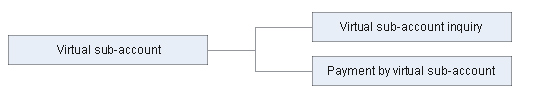

Virtual sub-account: to conduct individual account management, open virtual sub-account for corporate client's subordinate member which does not have the qualification to open bank account.

● Virtual sub-account management: providing function to set up virtual sub-account for master account and conduct sort management for funds in master account

● Virtual sub-account inquiry: providing balance inquiry, transaction details inquiry for virtual sub-account

●Payment by virtual sub-account: providing outbound payment, expenses management, internal transfer, interest calculation and accounting adjustment for virtual sub-account.

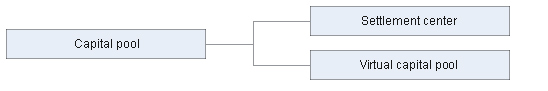

Capital pool: provide group client with settlement center, cross-border foreign currency capital pool and virtual capital tool

●Settlement center: with RMB physical capital pool, realizing inquiry and monitoring, aggregation and distribution, quota management, internal pricing, coordinated payment of funds in group and member's RMB accounts, supporting direct remittance and entrusted loan remittance.

●Cross-border foreign currency capital pool: with cross-border foreign currency capital pool, realizing inquiry and monitoring, aggregation and distribution, quota management, internal pricing, collective payment and collection, collective settlement and sale of exchanges of group and member's foreign exchanges.

● Virtual capital pool: with RMB virtual capital pool, while group and members are in the same "capital pool" account system, funds in member's account may stay out of aggregation in practice, but group can still pool fund information of members in real time to generate a virtual capital pool for overall management and utilization by the group.

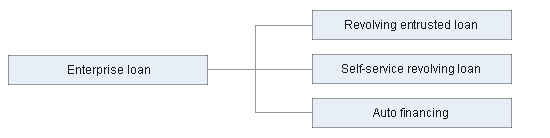

Enterprise loan: providing enterprise clients with circulating entrust loan, including inquiry about information of circulating entrust loan contract, repayment of circulating entrust loan, online auto financing

●Inquire about information of entrust loan contract: inquire about the information of contract on one-way circulating entrust loan account.

●Entrust repayment: Repay the principal of one-way circulating entrust loan.

●Auto financing: by cooperating with core enterprises and regulators, through online coordination between IB's online financing platform, core enterprises platform and regulator warehousing monitoring platform, IB provides upstream and downstream enterprises in auto supply chain with online financing service covering whole process.

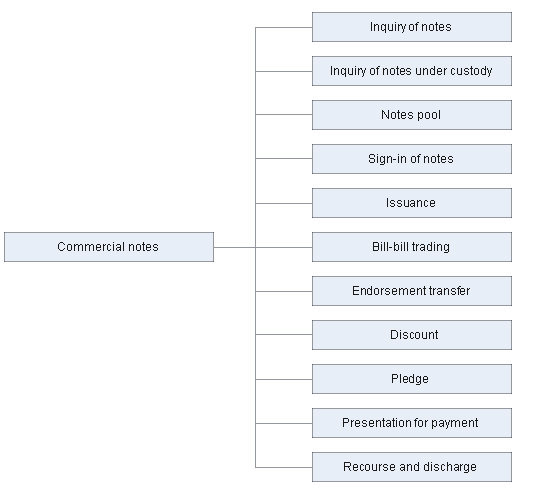

Commercial note: providing corporate client with functions such as issuance, endorsement transfer, discount, pledge, presentation for payment, recourse and discharge of electronic notes and etc.

●Issuance: online application for electronic bank acceptance and electronic trade acceptance

●Endorsement transfer: online transfer of electronic note

●Discount and pledge: online application of discount, pledge and other financing business

●Presentation for payment: bring presentation for payment to acceptor (payer) online and request acceptor (payer) to pay

●Recourse: if payment of notes is impossible to recover, initiate recourse to the last holder or other parties involving in notes transaction online.

●Discharge: for recourse application, agree to discharge payment of notes online.

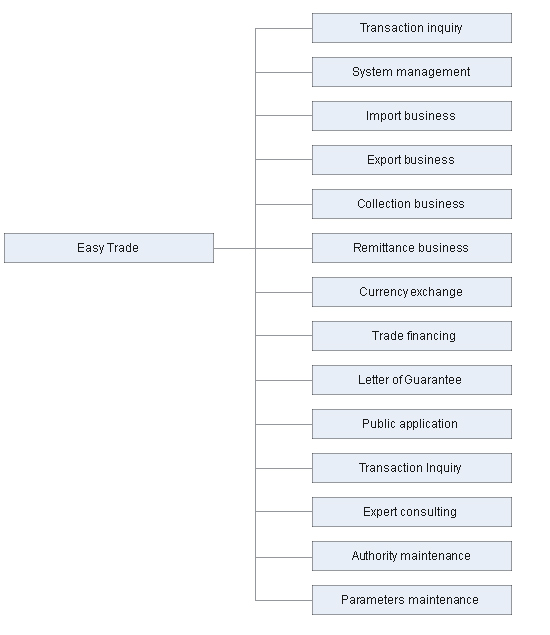

Easy Trade: provide corporate clients with international business service online

●Letter of Credit(L/C): edit application for L/C by self-service, issuance of import L/C, L/C adjustment application, arrival notice, payment acknowledgment, payment notice under import L/C, reception of export L/C, L/C adjustment application, mail notice, receipt notice of foreign exchange, agency production of export notes template, agency production of notes and etc.

●Collection: documents mailing for export collection, collection notice of foreign exchange, agency collection of import documents, payment acknowledgment, exchange payment notice and etc.

●Remittance: remittance application, remittance notice and etc.

●Letter of Guarantee(L/G): issue and change application of L/G, L/G notice and etc.

● Experts consulting online and by telephone: consulting with documents experts online or by IP telephone

●Online inquiry: inquire about and track processing status of trading online, inquire about historic trading record online and etc.

●Trading financing: outward documentary bill, application and notice for payment of documentary bill, forfeiting business application online, guarantee for delivery application online, guarantee for delivery notice and etc.

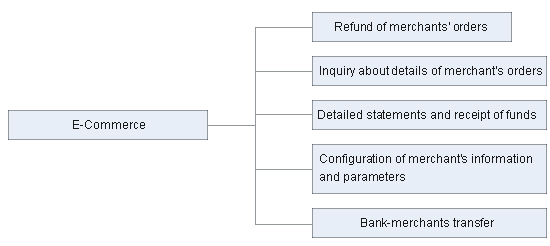

E-commerce: Providing enterprise clients with a platform to develop E-commerce, with the following E-commerce services and functions: refunding of merchant's order, inquiry about details of merchant's order, printing of receipt slip, and configuration of merchant's information, etc.

●Refunding of merchant's order: generate, cancel, inquire about and re-assign the order for refunding merchant's order.

●Inquiry about details of merchant's order: inquire about and download the details on the payment for merchant's order and inquire about the single order.

●Configuration of merchant's information: inquire about merchant's information, and modify the configuration of relevant parameters.

●Printing of receipt slip: download the detailed fund statement and print the summarized daily receipt slip.

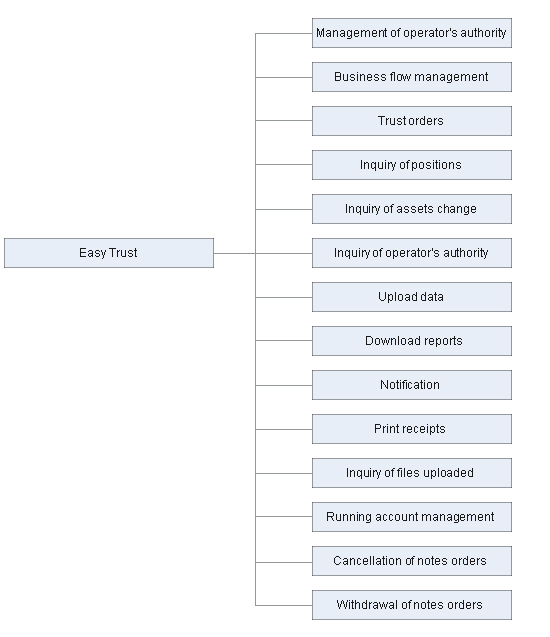

Easy Trust: Provide corporate client with custody service for securities investment funds and trust products

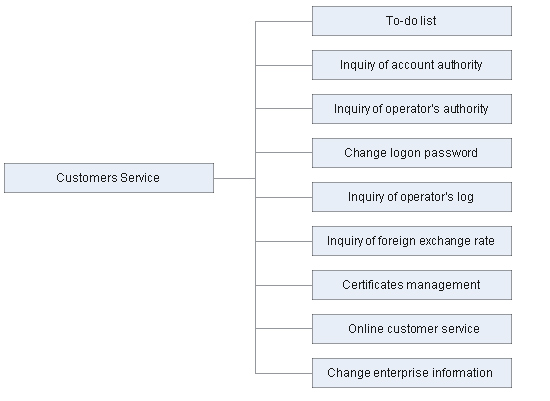

Customer service: provide corporate clients with services including inquiry of account authority, inquiry of operator's authority, enterprise information change, inquiry of operator's log, certificates management, online customer service, synchronization of account name, inquiry of foreign exchange rate and etc.

●功能列表

Account inquiry Corporate financial room Investment and wealth management Capital pool Virtual sub-account Commercial notes Enterprise loan Easy Trade Easy Trust E-Commerce Customers Service