Application Guide

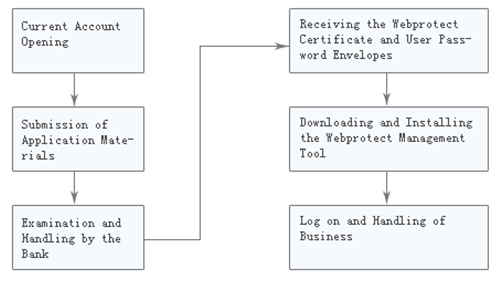

1. Current Account Opening: Please visit the nearest IB outlet to go through the formalities for account opening with the following documents: Business License and Organization Code Certificate (both originals and sealed duplicates), as well as the corporate seal and seal reserved with the bank (financial seal and personal seal). (Customers who have previously opened a current account may ignore this step).

2. Submission of Application Materials: Please take the “Application (Alteration) Form of Settlement Account Service of Industrial Bank” and the “Agreement for Corporate Internet Banking Service” at the depository bank. After filling up the form and agreement as required, affix the corporate chop and seal of the legal representative (person-in-charge) on the “service agreement” and affix the reserved seal on the “application form”. To activate the professional version, the applicant is required to present the ID cards of the director and administrator, both original and duplicate, to the depository bank. To activate the single-person or two-person version, the applicant is required to present the ID card of operator, both original and duplicate, to the depository bank.

3. Examination and Handling by the Bank: The Bank examines the materials submitted by the customer and goes through the formalities for opening internet banking service: the counter teller activates the internet banking for the customer, prints the user (including director, administrator and operator) password envelopes, and applies for prefabricating the Webprotect certificate, etc.

4. Receiving the Webprotect Certificate and User Password Envelopes: Receive the prefabricated Webprotect certificate and user password envelopes provided by the counter teller.

5. Downloading and Installing the Webprotect Management Tool: Log on the homepage of IB, click “Webprotect Management Tool” in the “Download Center”, and download and install the “Prefabricated Webprotect Certificate”. After installation, insert the prefabricated Webprotect and set the Webprotect password according to the system prompts.

6. Log on and Handling of Business:

(1) Single-person and two-person versions

Log on the homepage of the Bank (http://www.cib.com.cn), click the button “log on” for corporate internet banking, key in the certificate password to go to the logon page, and then directly log on the corporate internet banking system with the specific operator password to do business operation such as account inquiry and external transfer.

(2) Professional version

Please log on the corporate internet banking system with the administrator user, and conduct operations including setting business process and management of operators (adding operator or setting operator power):

Business Process Setting: Customers may, according to their own internal control requirements, set different business processes for different business modules (corporate finance office, corporate wealth management and group service, etc.). The default mode of the system is Level 2, namely handling and authorizing. You can set the business processes from one to five levels, based on your needs. Setting will come into force with the authorization of the supervisor.

Operator Setting: Users of corporate internet banking are divided into three kinds, namely supervisor, administrator and operator. Specifically, the supervisor and administrator are designated when the customer activates corporate internet banking and are generated by the Bank, while operators can be added by the administrator as needed according to business process. The operating steps are as follows:

(1) The administrator clicks “Operator Management” - “Add New Operator” to add an operator;

(2) The administrator clicks “Operator Management” - “Operator Power Setting” to set the authority of an operator;

(3) The setting will come into force with the authorization of the supervisor.

Business Handling: Log on the corporate internet banking system with a specific operator (handling, checking, authorizing, etc.) to process banking operations such as account inquiry and external transfer.