快捷支付

What isquick payment?

Answer: quick payment is an innovative way of payment provided by the Industrial Bank together with the third party payment institutionforthe Industrial Bank card users. It acts as a safe, convenient and easy payment solution for the users apart frominternet banking payment solution. The user can start to use the quick payment bybinding the bank card with the related payment account. Theuser needs to enter the password of the payment account to verify the payment (the specific verification method is in line withthe process issued by the third party payment institution). The Industrial Bank supportsquick payment of two banks, savings card (debit card) and credit card(the specific availability is in line with the notice issued by the third party payment institution).

Is quick payment safe and reliable?

Answer: in terms of quick payment, the Industrial Bank selects the cooperative partnerthrough a cautious security policy. All the partners need to havethe business qualification granted by the People’s Bank of China andmeet the account data security standard of the international banking industry(Note 1). The Industrial Bank will actively protect the legitimate rights and interests of its users andclients related to the quick payment.

With regard to security technology,it adopts multiplecertificationsin the account connection of quick payment, ensuring that each account connection bindingmust be authorized by the client. For all the transactions, the Industrial Bank will sendnotice and updates of the account to the customer through the registered phone number of the client.

Whichbusinessescan use the Industrial Bank card for quick payment?

Answer: at present, the Industrial Bank card providesquick payment for the following partners:

Chinese UnionPay (12306, Jingdong.com, Suning.com, online shopping malls of China UnionPay, Yihaodian, Shanghai Oriental TV Shopping Co., Ltd, dangdang.com, China Southern Airlines, Hainan Airlines, tuniu.com and so on)

Alipay(Tmall, Taobao, etao.comand other ecommerce websiteswhere Alipay is available.)

Tenpay (WeChat payment, paipai.com, yixun.com, etc.)

Online Banking(Jingdong.com)

99 Bill.com

ChinaPnR

How to activatequick payment?

Answer: The users can activatequick payment throughonline signing.

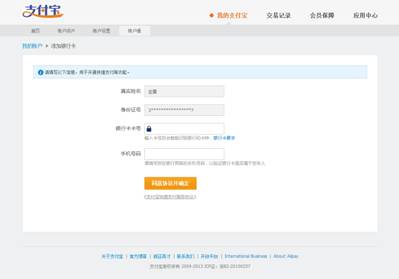

Step1:Add the Industrial Bank card to the signing section on the webpage of the third party payment institution in cooperation with the Industrial Bank, and enter your name, phone number and other information to verify. The phone number must be the one bound with the card. The security verification canbe madewith the premise that the mobile phone short message verification(dynamic short message) is available for the bank card.

Step2:Our cooperative partner will send a short message with dynamic verification code to you. Enter the verification code on the mobile phone verification webpage to ensure your operation.

Step 3:Your information will be verified. The account connection of quick paymentis finished when you go through the verification. Then the quick payment is available to you.

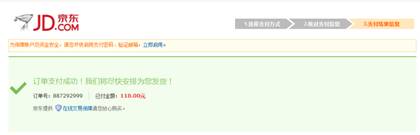

Pictures of the above steps:

Online payment of China UnionPay:

Pictures of activating the Tenpay:

How to makequick payment through a connected account?

The users can go shopping online on the websites where quick payment is available,select the way of quick payment that is bound with the Industrial Bank card (see the specific operation on the webpage of user’s guide to payment websites) and enter the mobile phone dynamic password (not the transaction password of the bank card). Then the quick payment is done; the following paymentsonly needthe password of the account or the dynamic short message password.

Is there a limit to the amount of quick payment?

Answer:

For debit card, there is a 5000-yuan limit to the amount of quick paymenton the default day it was activated, while for TenPay, Alipay, Jingdong and other commonly used businesses, the limits to the quick paymentrange from ten thousand yuan to fifty thousand yuan. The limits differ and the specific amount takes the respective notice as the standard, such aspayment help or payment notice on thewebpage.

Forcredit card, the limits also differand the specific amount takes the respective notice as the standard, such as payment help or payment notice on the webpage.

How to change the connected phone number of the quick payment?

Answer:

For debit card: in order to ensure your capital security, you need to bring your ID card to the counter of the Industrial Bank to change the mobile phone numberand open theshort message notice of account changes for the new mobile phone number. After the change, you need to logon your account inthe related cooperative partners (such as accounts of Alipay or Tenpay), change the corresponding mobile phone number of the quick paymentcard and complete the verification and binding;

For credit card:apart from the way similar to that of the debit card, the user can alsocall 95561 and ask the personnel to change the mobile phone number for you. You need to set the transaction passwordand at the same time your original mobile phone number willreceive a short message for verification.Once you pass the verification,your mobile phone number can be changed.Thenlog your account in the related cooperative partners (such as accounts of Alipay or Tenpay), change the corresponding mobile phone number of the quick payment card and complete the verification and binding.

How to disable or freeze Quick Pay?

Answer: Users who already activated Quick Pay can disable the function or delete your IB card at the accounts of the partner merchants. Alternatively, users can freeze Quick Pay function of designated merchant by calling 95561, or freeze the function of relevant card by logging on IB Internet banking (signing and inquiry page of Quick Pay).

Note 1: Including PCI or Account Data Security Standard (ADSS) for Unionpay cards. Jointly released by VISA, American Express, JCB and MasterCard, Payment Card Industry (PCI) certification is the strictest and highest level safety certification standard for financial machines and equipment.