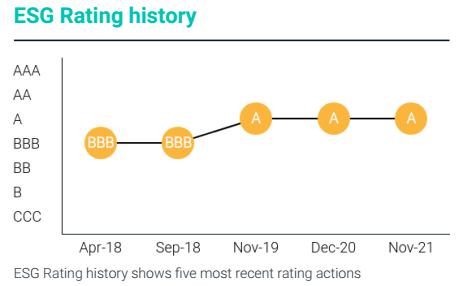

[ESG Management and Practice] IB Wins MSCI ESG Rating at A for Three Consecutive Years.

In November 2021, MSCI released the 2021 ESG rating results in which IB was rated at A, the highest level in the banking industry of mainland China, who is also the only banking institution in the domestic banking industry with rating A for three consecutive years.

MSCI rated 191 banks listed in the MSCI ESG index, mainly focusing on three aspects: environment (E), society (S) and governance (G), and referring to 10 issues and 37 key indicators. The key issues of the banking industry mainly focus on environmental impact, consumer rights protection, human capital development, inclusive finance, privacy and data protection, corporate governance and behaviors. Among these banks, IB has outstanding performance in environmental impact, inclusive finance, privacy and data security, ranking the leading level in the industry.

As the first EPFI in China, IB has been deeply engaging in green finance for 16 years, who has established a solid leading position through continuous innovation and has actively grasped the strategic opportunity of “carbon peaking and carbon neutrality”. In a new round of the five-year plan, IB has focused on the “green financing” as the first out of its three business cards, and formulated the goal of doubling the scale of green financing within five years. By the end of November 2021, it has provided a total of RMB 355.32 billion in green financing to 40,149 enterprises, and the projects supported are expected to save 38.45 million tons of standard coal and reduce 98.3 million tons of carbon dioxide emission per year in China.

In terms of inclusive finance, IB actively practices the concept of social responsibility of “integrating righteousness with profitability”, comprehensively uses group resources and diversified financial instruments, gives full play to its unique advantages, strengthens technological empowerment, and relies on such open platforms as the Bank-Bank Platform, Fujian “Financial Service Cloud Platform” and “IB Inclusive Cloud Platform” to explore new business models in inclusive finance such as microfinance and rural finance, and contribute its financial strength to support people’s better life. By the end of November 2021, the balance of small and micro inclusive loans was RMB 289.7 billion, with an increase of RMB 76.4 billion and an increase rate of 35.78% compared with the beginning of the year; the number of small and micro inclusive loans exceeded 144,500; and the balance of agriculture-related loans exceeded RMB 470 billion, with an increase of 10% compared with the beginning of the year.

In terms of privacy and data security, IB released the first white paper on data compliance in the banking industry in 2021, the White Paper of the Industrial Bank on Data Compliance, and built a data compliance system with the goals of “rights protection, unified language, and expanded application”, including eight main aspects in content, i.e. working mechanism, institutional system, customer education, and personnel training, which marked IB’s significant leap from concept integration to strong practice in the field of privacy and data security protection of.

At present, the ESG performance of listed companies is getting more and more attention from financial regulation and international investors. A higher ESG rating reflects the good practice of more sound management and standardized governance of banking institutions, and also means wider market recognition, which is favored by more investors.

“Maintaining the MSCI ESG rating at A for three consecutive years is a full affirmation of IB practice of ESG philosophy and its commitment to be an active promoter and industry leader in the ESG field. It will also inspire the Bank to continue to adhere to the concept of sustainable corporate governance and continuously improve the social responsibility practice of “integrating righteousness with profitability”, and strive to create greater social values and promote more harmonious development of economy, society and environment,” said the relevant leader of IB.