SMS Protection

●Services Overview

SMS Guard is a way of trade confirmation aided by SMS verification when you use the IB E-Finance Platform (Personal Online Banking, the IB Mobile Banking APP, and phone banking) for external payment. After this function is activated, you have to enter both the password of your account and the one-time SMS verification code sent to your contract mobile phone number, so as to ensure the transaction security via two channels.

●Features and Advantages

SMS Guard is able to realize the goal of the dual-authentication of account password+SMS verification, so as to enhance the security of the authentication of E-Finance transactions.

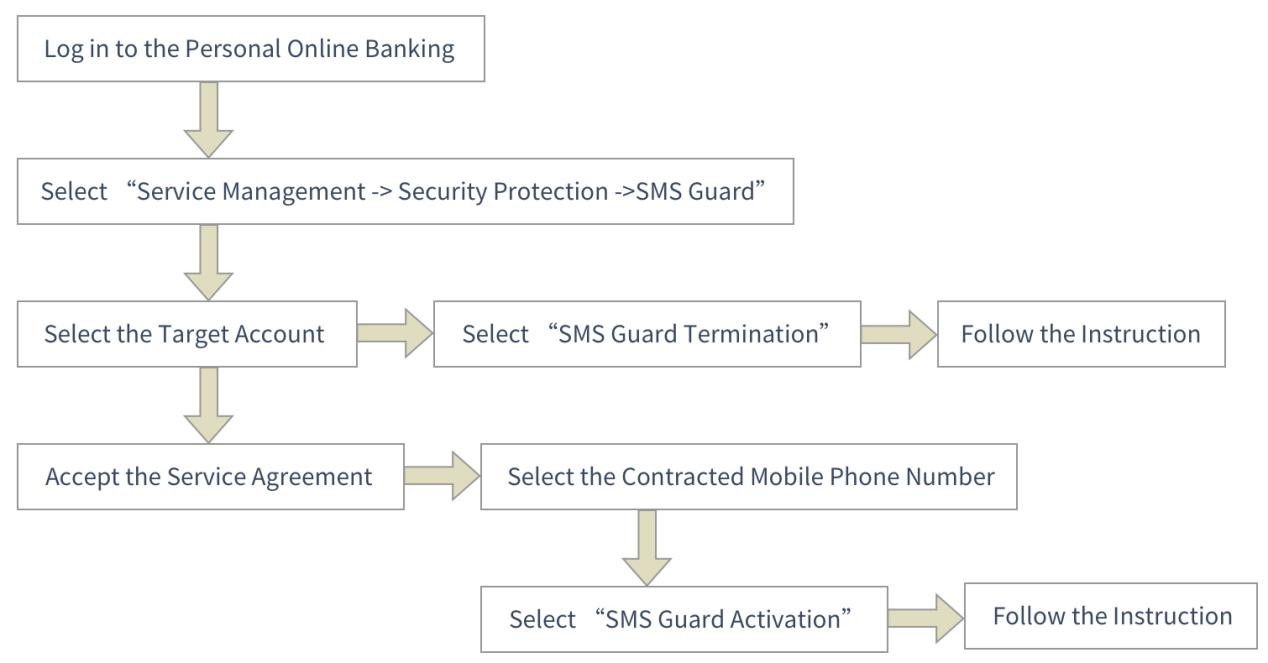

●Application Process

Wealth Management Card

1. If you are already a NetShield Customer of the IB E-Finance Platform,

Please activate the Safe Guard using your NetShield in [Service Management-Security Protection-SMS Guard].

2. If you do not have a NetShield of the IB Personal Online Banking Platform

The self-service for the opening of the SMS Guard is not available, you have to make your application in an IB’s branch.

Credit Card

The application by credit cards is available as default, and the borrower’s latest-registered mobile phone number in IB will be linked to the SMS Guard.

●Charging Standard

The SMS Guard service is free of charge for now.

●Notice

1. The external payments referred in the SMS Guard include transfer and remittance, bill payment, online payment, mobile payment, etc.

2. The functions of the inquiry, opening, and termination of SMS Guard are available by using NetShield, without which only the inquiry function is available.

3. When you are using the self-service opening of SMS Guard, IB will send a one-time verification code to your contract mobile phone number for the completion of the process.

4. When you terminate the SMS Guard function, IB will send a one-time verification code to your former contract mobile phone number for the completion of the termination