Strengthen Consumer Financial Protection training for all employees

--Exhibition of Achievements of Key Training Program for Consumer Financial Protection in 2023

(Employee training on consumer financial protection)

In order to regulate the code of conduct of the Bank’s employees at all levels to protect consumer rights and interests and promote the integration of consumer financial protection compliance into products and services, Industrial Bank issued the 2023 Training Plan for Consumer Financial Protection and Service at the beginning of the year to improve training effectiveness by strengthening the interpretation of regulatory policies and cases, optimizing training forms, strengthening guidance and training on measures for handling consumer financial protection complaints, and so on.

For example, relying on the “Xingzhi” app, an online learning platform, the Bank has launched “Industrial Bank Learning,” or Quan Xing Xue, a dedicated section for bank-wide learning of consumer financial protection, particularly including senior leaders’ work instructions on consumer financial protection, and the guiding principles of meetings on consumer financial protection. All bank employees are required to log in to the platform to learn and pass the test.

Moreover, the consumer financial protection Office of Industrial Bank is devoted to guiding and supervising the review of consumer financial protection, collecting and analyzing typical cases of financial marketing and publicity that infringe on the legitimate rights and interests of consumers, and collaborating with the Bank’s business departments in guiding the Bank’s financial marketing and publicity work in different forms such as training, circulars, and articles. The trainees include middle and senior managers of the head office and branches, primary business personnel, and new employees. Each training is required to cover all personnel. For business positions that are the targets of frequent complaints from financial consumers and face high risks, it is necessary to give more targeted training, increase training frequency, strengthen the summary and evaluation of training results, etc.

★Exhibition of the Head Office’s key training projects on consumer protection in the first half of 2023

01 Training on interpretation of the key content of the Administrative Measures for the Protection of Consumer Rights and Interests by Banking and Insurance Institutions

Keeping abreast of regulatory policies, the Head Office provided training in March on the interpretation of the key content of the Administrative Measures for the Protection of Consumer Rights and Interests by Banking and Insurance Institutions (Order No. 9) that were recently promulgated and implemented. Centering on the eleven working mechanisms and eight codes of conduct for the protection of rights and interests of financial consumers, the Bank guides business departments and branches to clarify the implementation of the Bank’s policies on consumer financial protection, promotes all units to gain an in-depth understanding of the Order No. 9, and evaluates the basic strategy on consumer financial protection in the next stage, thereby boosting the quality and efficiency of the Bank’s Consumer Financial Protection work. 6,553 staff members participated in the training.

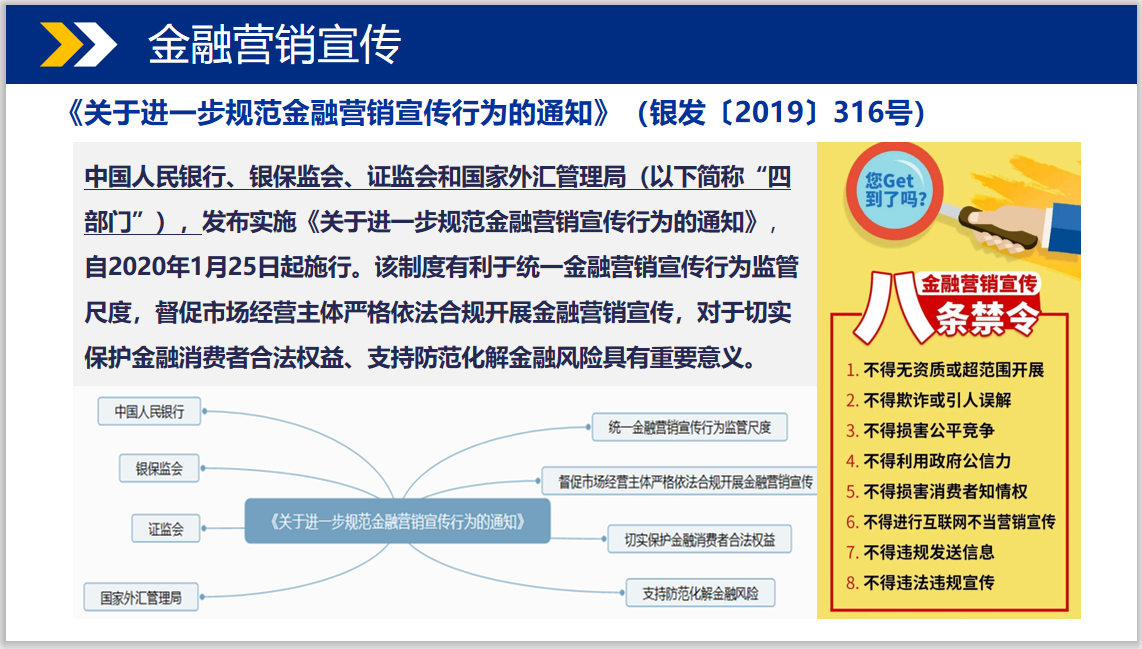

02 Training on Product/Service Reviews of consumer financial protection

In May, the Consumer Financial Protection Office of Industrial Bank carried out bank-wide review training on the protection of financial consumer rights and interests, which combines the eight pieces of rights and interests of financial consumers as well as the requirements of the regulatory system. It focuses on the key points and typical cases related to the protection of consumer rights and interests for product or service, such as standard marketing language and risk warnings that are intimately associated with marketing and publicity. It stresses that the Bank’s business units at all levels, which are the agencies implementing policies on consumer financial protection, should take the lead in managing consumer financial protection during the marketing and publicity of centralized business activities, pool key resources, and coordinate and regulate business marketing, and implement the Administrative Measures of Industrial Bank for the Protection of Consumer Rights and Interests in Financial Marketing and Advertising. 1,258 personnel participated in the training, including personnel involved in consumer financial protection management at the head office, branches, and subsidiaries.

03 Training on complaints management of consumer financial protection

Following the guiding principles of the Chairman’s instructions on “focus on implementation and strive for a new height”, the head office held training on the management of consumer protection complaints on July 31, 2023, to regulate and deepen complaint management, enhance the professional ability of complaint management personnel, and make further progress in complaint management and reduction.

The training primarily focuses on two areas: regulating complaints management and sharing of branches’ excellent experience. The consumer financial protection Office made a detailed introduction to the complaint management specifications and requirements as well as the functions and usage of the complaint management system. The Nanjing Branch shared experience in complaint handling and control.

There were a total of 682 trainees, including complaint management personnel from subsidiaries, 44 branches, and members of the Leading Group of the Head Office for Consumer Financial Protection Service. After training, the trainees said that the training session was practical, and helped them learn more about regulatory requirements as well as the requirements of the Bank’s complaint management norms. Branches will carry out their respective re-training to ensure that the training covers complaint-handling personnel in all in-scope branches.

★ Expand training channels

· Industrial Bank offers a variety of online and offline courses in response to the work scenarios of employees as well as the common needs of consumers.

· Relying on the “Xingzhi” app, an online learning platform,the Bank provides practical training courses that cater to the needs of frontline employees, such as “Quality Standards for consumer financial protectionServices at Outlets”, “Bank Application of Standards on Consumer Complaint Classification”, “Analysis of Typical Cases of Consumer Financial Protection for Key Businesses”, and “Industrial Bank's 50 Red Lines on the Protection of Consumer Rights and Interests.” By providing employees with an online learning platform, the Bank facilitates learning for the employees.

· The Bank organizes multiple consumer financial protectiontraining sessions at the department and branch levels to help employees gain systematic knowledge of policies and rules, complaint-handling skills, and concepts of compliant selling, laying the groundwork for consumer financial protection work among primary business personnel.

· Moreover, various institutions of the Bank also organize frontline staff of business outlets to carry out self-learning during morning and evening meetings.

----------------------

Next stage, the Bank will continue to organize training such as training on improving the quality and efficiency of consumer financial protection. It will focus on key business areas, and upload the key points of training to the “Xingzhi” app for the benefit of the Group’s personnel. At the same time, the training will focus on the key points and typical cases of marketing terms, wealth products, advance notifications, key reminders, information protection, and other activities that are closely associated with marketing and publicity. It will raise the employees’ awareness of consumer financial protection services in the marketing area, harmonize the supervision standards for financial marketing and publicity, and protect consumers’ financial rights and interests.