Focus on consumer demands and regulate complaint handling

The bank place a high value on the work of handling consumer complaints. In early 2023, in accordance with Chairman Lyu Jiajin’s instructions on “To treat the symptoms and the root causes alike, prioritizing symptom treatment, but focusing on addressing the root causes, propels the bank's consumer financial protection efforts to a new level”, A 'hundred-day campaign' focusing on complaint management has been launched across our entire institution, with all members working in unison to advance the reduction of complaint volumes The Head Office has effectively promoted complaint management through a slew of measures such as supervision of key branches, holding special meetings, issuing 10-day work reports, complaint warning letters, and warnings for typical complaint cases, and interviewing badly performing institutions. As a result of the bank-wide efforts, the number of complaints filed through the former China Banking Regulatory Commission channel in the first quarter of 2023 was 2,788, down by 41.9% from the same period last year, and the ranking in the trade in terms of number of complaints fell by four places compared with the same period last year. The complaint management work yielded remarkable results.

· Analysis report of financial consumer complaints in the first half of 2023

In the first half of 2023, the company received 200,126 consumer complaints through all channels, with a monthly average of 16.14 complaints per outlet, a complaint rate of 0.21%, and a consumer satisfaction rate of 99.76% for complaint handling. In the first half of 2023, the number of consumer complaints received through all channels decreased by 54,868, or 21.52%, compared with the same period last year. In the first quarter of 2023, the number of complaints received by the company through former banking and insurance regulatory channels was 2,788, a decrease of 2,018 compared with the same period last year, down by 41.9% (the data for the second quarter is not yet released). The facts and figures of consumer complaints are as follows:

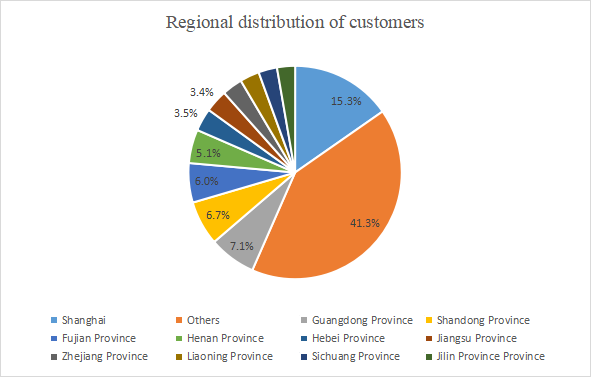

1. From the perspective of the regional distribution of consumer complaints, the Yangtze River Delta region had the most complaints. The number of complaints was 30,634 in Shanghai, accounting for 15.3%, 6,874 in Jiangsu Province, accounting for 3.4%, and 6,176 in Zhejiang Province, accounting for 3.1%. The number of complaints in the Pearl River Delta region (referring to Guangdong Province) was 14,295, accounting for 7.1%. The number of complaints in Beijing and Hebei Province was 5,434 and 6,923 respectively, accounting for 2.7% and 3.5% respectively. In the Chengdu-Chongqing region, the number of complaints in Sichuan Province and Chongqing was 5,642 and 3,495 respectively, accounting for 2.8% and 1.7% respectively. In other key regions, Fujian Province had 11,933 complaints, accounting for 6.0% and Shandong Province had 13,485, accounting for 6.7%.

2. From the perspective of the handling channels of the complained business, there were 78,014 complaints through front office business channels, accounting for 38.98%, and 122,112 complaints through middle and background business channels, accounting for 61.02%. For complaints received through front office business channels, there were 16,759 complaints through the business site, accounting for 21.48%; 60,229 complaints through electronic channels, accounting for 77.20%; and 1,026 complaints through other business channels such as self-service machines and third-party channels, accounting for 1.32%.

3. From the perspective of consumer complaint types, credit card business complaints accounted for 87.14%; debit card business complaints accounted for 5.49%; loan business complaints accounted for 4.14%; complaints about self-operated wealth management and banking agency business accounted for 1.24%; payment and settlement business complaints accounted for 0.26%; RMB savings and RMB management complaints accounted for 0.12%; complaints about other business such as foreign exchange, precious metals, and personal financial information accounted for 1.61%.

4. From the perspective of reasons for consumer complaints, there were 69,259 complaints about the management rules, business rules and processes of financial institutions, accounting for 34.61%; there were 107,045 complaints about methods and means of debt collection, accounting for 53.49%; 17,666 complaints about marketing methods and means, accounting for 8.83%; 2,557 complaints about service attitude and quality, accounting for 1.28%; 1,841 complaints about service facilities, equipment, and business systems, accounting for 0.92%; 684 complaints about consumers’ fund security, accounting for 0.34%; 456 complaints about pricing and charges, accounting for 0.23%; 130 complaints about information disclosure, accounting for 0.06%; 488 complaints about other reasons such as independent choice, product earnings, information security, and contract terms, accounting for 0.24%.

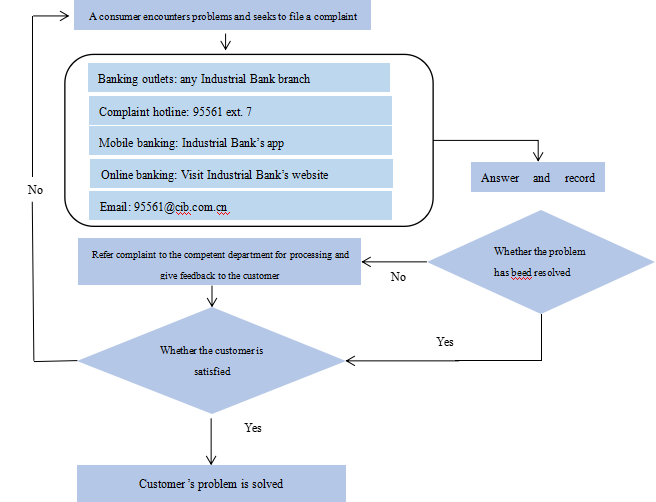

·Channels for receiving consumer complaints

Business outlets: Report problems to lobby managers of banking outlets, branch managers, and other staff; leave messages on the customer feedback form; through the complaint hotline announced by business outlets.

·Customer helpline: Call our 24-hour helpline 95561 ext. 7.

·Email for accepting customer complaints: 95561@cib.com.cn.

·Mobile banking: Industrial Bank mobile banking app.

·Online banking: Visit Industrial Bank’s website.

·People’s Bank of China inquiry and complaint hotline for financial consumer financial protection: 12363.

·Banking and insurance consumer complaint and rights protection hotline: 12378.

·Local financial consumer dispute resolution centers.

·Process for handling complaints

·Timeframes for handling consumer complaints

The time limit for handling and responding to complaints is strictly regulated. For simple consumer complaints with clear facts, a decision on handling shall be made and notified to the complainant within 15 days from the date of receiving the consumer complaint. The time limit may be extended to 30 days if a complaint is complicated. If a complaint is particularly complicated or involves other special reasons, it may be extended for another 30 days after the higher-level institution or the senior management of the Head Office recognized by the regulatory body gives approval and the complainant is notified.

·Consumer complaint handling satisfaction

Better management is provided in respect of consumer satisfaction with the handling of consumer complaints. We learn about consumers’ satisfaction with the handling of complaints in a timely manner through return visits and supervise the quality of complaint handling. In recent years, the level of satisfaction with our consumer complaint handling has improved, from 99.02% in the first quarter of 2022 to 99.66% in the second quarter of 2023.

·The “magic weapon” for complaint management

1. Always putting customers first. From the perspective of consumer experience, we delve into the causes of consumer complaints, step up efforts to handle complaints, and tackle problems at the source.

2. Adhere to the system of responsibility for first contact. Any institution or individual who is the first to receive a consumer complaint, regardless of whether the problems concern their department, should act proactively to promote the one-stop resolution of complaints and track the complaint handling process in line with the principle of “resolving disputes on the front deskimmediately”, ensuring the closed loop of consumer complaint handling.

3. Adhere to the system of accountability to the bank. Institutions at all levels should actively and properly handle consumer complaints received, regardless of whether they are directly responsible for the complaint, and must not prevaricate or refuse consumers’ demands.

4. Adhere to efficient handling. We are highly sensitive to consumer complaints, respond quickly to emerging consumer complaints, conciliate complaints in a timely manner, and increase the one-time resolution of complaints.

Oversight of Complaints Management level committee

The Board of Directors of the Bank and its Risk Management and Consumer Financial Protection Committee have always attached great importance to consumer complaints work by regularly studying and reviewing the summary, plan, and related rules of consumer financial protection including complaint management, studying regulatory evaluation materials such as consumer complaint reports in the banking industry in a timely manner, analyzing and studying problems in complaint management, urging the management to step up efforts to rectify existing problems, and hearing rectification reports, thereby improving the Bank’s complaint management. Furthermore, the Bank has put in place an independent and complete regular consumer financial protection audit mechanism to supervise and evaluate the performance of consumer financial protection duties, including complaint management.

Institutional improvement

To implement the customer-centric service philosophy and regulate the Bank’s complaint handling and management, we have formulated rules and regulations such as the Detailed Rules of Industrial Bank for the Implementation of the Measures for the Administration of Consumer Complaints and the Industrial Bank Plan for the Protection of Consumer Rights and Interests and Emergency Response to Major Consumer Complaints in line with regulatory requirements, which are important steps for the protection of consumer rights and interests. It is aimed at providing efficient, fair, and transparent complaint handling and management mechanisms.

IT-based system construction

Industrial Bank, as a pilot bank for the standardization of regulatory complaint classification, is the first in the industry to independently develop a complaint management system, which has been praised by the regulatory authorities many times. At the same time, the Bank consistently carries out scientific and technological innovation, and employs big data technology to optimize the big data function of the complaint management system. The bank upgrades functions such as AI classification, complaint alerts, complaint label management, consumer complaint profile, and data analysis to provide effective support for intelligent management, classification, and analysis throughout the complaint process.

Complaint indicator control

We set multi-dimensional complaint management assessment indicators as well as annual and phased complaint management targets including time limit for complaint handling, level of satisfaction with complaint handling, and the proportion of complaints transferred from the regulatory body. The Bank regularly monitors indicators, includes them in complaint notification and assessment, gauges the effectiveness of complaint management work through complaint management indicators, and urges all institutions to tighten complaint management, thereby improving the quality and efficiency of complaint management.

Complaint analysis and monitoring

Industrial Bank’s Consumer Financial Protection Office regularly conducts analysis, monitoring, and reporting regarding consumer complaints received through all channels of the Bank, with a focus on the prominent and typical complaints and causes in the current period, finds out weaknesses in the complaint management and handling process, and puts forward work requirements. Regarding business problems that are prominent, typical, or frequently reported by consumers, the Bank sends the Notice on Rectification of Complaints for Consumer Financial Protection, Warning Letter of Consumer Complaints, etc. to relevant institutions to urge them to ensure problem analysis and rectification, and promote product and service enhancement.

Promoting traceability and rectification

The Bank underscores the primary responsibility for complaint management, assigns top officials to take charge of relevant affairs, and puts in place a key support mechanism for interviews with the leaders of underperforming institutions as well as institutions with prominent problems. The Bank tightens the source management of complaints, continues to improve the consumer financial protection process, and prevents the launch of flawed products and businesses. The Bank focuses on rectifying complaints from key business, fosters inter-department collaboration, promotes timely communication, and propose solutions to unravel knotty problems. The Bank strengthens the business guidance of branches, regulates process management, and emphasizes regulatory compliance in business.

Enhance complaint handling

The Bank regulates the management of the complaint-handling process, increases complaint response and handling efficiency, and encourages in-scope institutions to resolve consumer conflicts and disputes through multiple forms such as third-party mediation. At the same time, the Bank has developed systems including emergency response plans for major consumer complaints and regularly organizes drills for emergency plans to improve the capability in emergency response to major complaints.

Whistleblower protection

The right to a complaint is part of the legitimate rights and interests of consumers. Industrial Bank supports consumers in filing reasonable complaints and actively meets consumer demands. We emphasize the responsibility to protect complainants and whistleblowers and strictly prohibit reprisal against complainants and whistleblowers, which is stressed in the bank-wide training for complaint management personnel. Furthermore, the Bank has a clear reward and punishment mechanism for complaint management and punishes and holds accountable institutions or individuals who fail to handle complaints effectively or cause major complaint risks.

Industrial Bank will consistently pay attention to consumer complaints, regulate the complaint handling process, safeguard the financial rights and interests of complainants, use consumer complaints as a valuable source of information for improving business and services, consistently optimize products, businesses, processes, systems, services, etc., and communicate with consumers to improve consumer experience.