Internet Finance

1. Financing Direct Express

*Product Definition

Financing direct express is an online financing product the Bank provides to enterprise customers. As an easy, safe and efficient product, based on our internet banking, it enables self-service application of loan, automatic release, payment at liberty and automatic repayment, thus meeting reasonable capital demand of enterprises in operation development, and reducing its financial burden.

*Service Advantages

(1) Borrow at any time needed: When the enterprises need loan, they can submit application on internet banking, the system will extend the loan automatically and make the payment immediately, requiring no approval procedure and accelerating capital turnover.

(2) Flexible and intelligent: The loan parameter could be set in the system. Within agreed period and quota available set forth in contract, the enterprises can withdraw money in one or multiple time(s) according to their actual capital demand, and repay the loan online, and the quota will be recovered immediately after repayment. The loan can be used in recycle and effectively improve the efficient of capital use.

(3) Safe and convenient: A payee of payment can be set in the system in advance, after successful extension of loan, the funds will flow only to the specified target. If payment failures, the system will notify account manager by SMS, so the bank can track and urge customers to finish the outward payment of loan, preventing capital risk effectively.

*Target Customers

Enterprises customers that need self-service loan

2. Assets Direct Express

*Product Definition

Assets direct express is a comprehensive sales platform for inter-bank trading of internet products for internal and external customers, and also a key outlet of internet portal. As a hit product of IB’s internet comprehensive service portal for corporate finance, Assets direct express will provide customers with diversified, multi-channel and multi-variety finance service, and increase the Bank’s cash management service and core competitiveness.

*Product Features

(1) As a platform dedicated to corporate wealth management, it features rich and low minimum purchase amount of products and stable revenue.

(2) Easy operation: Customers can buy right after register, saving time of queuing at counter.

(3) Safe and reliable: The closed management of capital fully safeguards the enterprises’ capital.

(4) Quality capital management service: The Bank provides quality customers with tailored professional and dedicated assets service, helping them to better manage their capital.

*Target Customers

Customers with needs on investment and wealth management

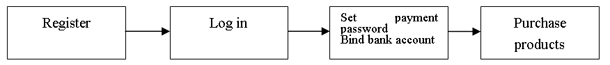

*Business Procedures

3. Payment/Collection Direct Express

*Product Definition

The product covers intelligent payment/collection engine, cloud service and data service, based on emerging internet finance technology, provides corporate finance customers with intelligent basic settlement and payment service. It also provides internet portal even bank wide online payment and settlement business with capital transaction channel and diversified financing channel, and accumulates transaction data for big data and platform service on corporate finance.

*Product Features

The payment/collection direct express covers local, remote and inter-bank payment and collection channels, addresses customer’s demand on payment/collection, integrates third party payment channel, thus building an optimal payment engine with intelligent matching. It also creates a complementary and integral product system based on national and regional PBC payment system, PBC authorized organizations and third party payment organizations, and as the management and trading center of our internet payment and settlement business for corporate finance, serving customer’s payment and settlement.

*Target Customers

(1) Production and/or sales based customers with online or mobile inter-bank capital settlement channels;

(2) Enterprises that are engaged in real economy, own chained business and have recovery demand of sales revenue of long recovery cycle;

(3) Group enterprises that have capital aggregation needs for subsidiaries or offices.

TOP