Trading Platform

1. Bank-business Platform

*Product Definition

IB’s bank-business platform is designed to provide spot transaction market, financial equities trading platform, large e-business and leading enterprises with comprehensive financial services including the settlement, liquidation, depository and online financing of trading funds.

*Business Content

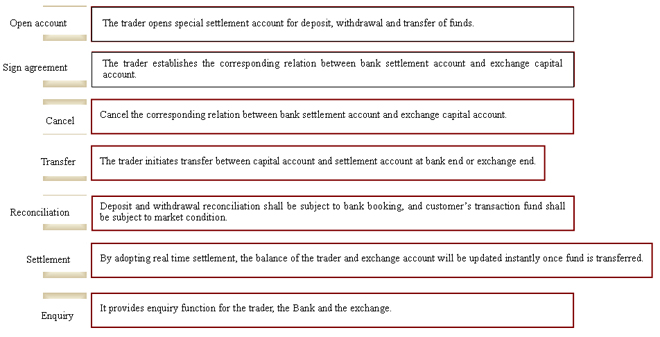

(1) Intra-day transaction: signing and cancelling of accounts, funds transfer between the Bank and the exchange, real-time enquiry of settlement funds, agency account opening

(2) End-day settlement: transaction statement, error treatment, backup and recovery of data

(3) Trading channel: counter, internet banking

*Advantages

(1) One point access, bank-wide sharing: HQ interfaces with HQ across the country, save time and financial cost; the branch in which the exchange is located plays the role of hosting branch, making the communication smooth and efficient.

(2) Concentrated data, convenient transaction: universal saving and withdrawal across the bank, capital arrives instantly; real-time capital change and real-time inquiry about account position; two way transaction available.

(3) Instant settlement, smart treatment: introduce active reverse mechanism, secure funds and no funds en route.

(4) Resource complementarily, joint promotion: the Bank’s channel resources complement with the exchange’s, and achieve joint promotion of business.

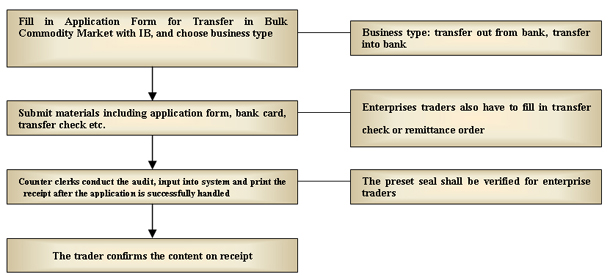

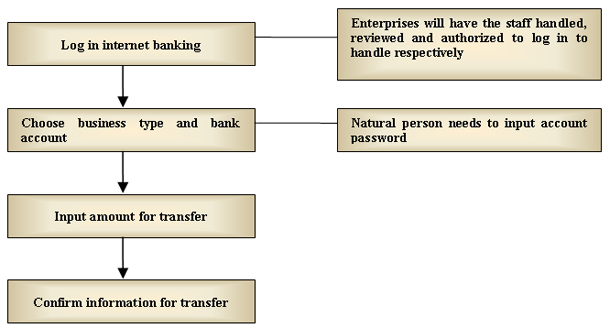

*Transfer procedures at bank end

• The procedures of capital transfer in the Bank’s business outlets

• The procedures of capital transfer via internet banking

2. Depository of Deposit

*Product Definition

The depository of deposit is designed to provide electronic bid market, including centralized procurement, land auction, equity transaction, constructional engineering, with professional financial service, such as transfer of deposit, identification of objects, settlement and depository.

*Business Content

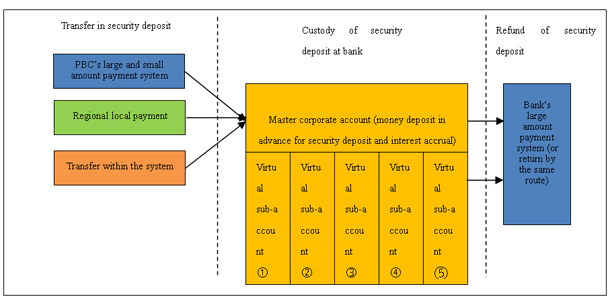

(1) Deposit transfer-in. The enterprises can transfer deposit into designated sub-account by various remittance route (mail route) which will be used as verification data for submitting bid or admittance, and the deposit business system will trigger the depository of deposit to notify bid inviting platform.

(2) Deposit interest accrual. The interest will be calculated based on individual virtual sub-account for the bidder, and the interest may be refunded as requested by the customer.

(3) Deposit enquiry. Enquiry by account number or total project deposit.

(4) Refund of deposit after bidding. The banking wholesale system will be used to refund deposit (principal and interest) to customers after bidding.

(5) Deposit confiscation. This module carries the function of deposit confiscation. The system will reduce corresponding project deposit limit of the bidder subject to such confiscation, and submit payment order to the bank end.

Relation between trading market and Industrial Bank

*Advantage

(1) Information security. The depository of deposit in the Bank will be communicated by dedicated lines and encrypted message, completely eradicating disclosure of information and assuring the information is communicated strictly within the system.

(2) Convenient for customers. The bidding customers need not to open account in the Bank. By virtual sub-account, the Bank can position bidding customers and bidding section precisely, meeting the requirement of inter-bank bidding of other bank’s bidder. The bid invitation business is fully electronic, including automatic matching, reconciliation and refund, thus reducing workload for financial staff and increase work efficiency of bid invitation platform.

(3) Capital appreciation. The functions of interest calculation by individual account and automatic refund solve the contradiction between the deposit interest calculation by the tenderer and the bidder.

(4) Standardized operation. The Bank has rich project experience and standardized operation, and will try best to meet schedule requirement of customers.

(5) Extended service. The Bank has close cooperation with domestic professional companies engaged in bid transaction, and for customers that develop land bid transaction business for the first time, the Bank can introduce software supplier to customers with our resources advantages.

3. Prepaid Card

*Product Definition

By virtue of certain media, the Prepaid Card Service System (“Card System”) of IB achieves standardization and automation of information resources management, including the generation, collection, transmission and summary analysis of business data. The Card System includes those for public use and for civil use, depending on the nature of relevant industry. Public prepaid card, such as for consumption, public transportation and social security. Civil prepaid card, such as for enterprises, organization and campus, generally used in access control, attendance check, meal, management of parking lot, consumption management and control of water and power. Depending on specific industry in application, the customers of prepaid card include intelligent enterprises, work camp, digitized campus and medical organizations.

*Business Content

(1) Issuance management. The Bank works with cooperative enterprises to make and issue joint prepaid card, and adopts centralized account management mechanism.

(2) CRM system. It provides cooperative enterprises with functions such as membership management, discount information management, points management and rebate management. And the users can store its card information into cell phone, realizing payment without card.

(3) Transaction support. Support consumption and top up, consumption with points and merchants discount management, etc.

(4) Liquidation and reconciliation. It supports enquiry of consumption details, reconciliation and financial statement etc.

*Target Customers

(1) Single purpose prepaid card of trading companies such as department store, chained merchants and supermarkets, for the consumption of their customers;

(2) One card pass of school, hospital, industrial park or enterprises, for the access control, attendance check and meal of their employee;

(3) Public service industry, such as consumption card for metro, bus and park.

TOP