Guarantee

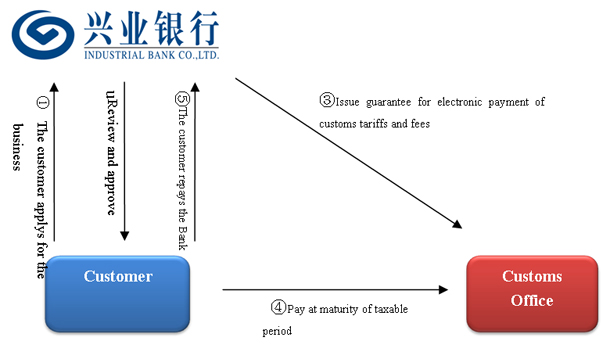

(I) Guarantee for Electronic Payment of Customs Tariffs and Fees

1. Product Definition

Guarantee for electronic payment of customs tariffs and fees: upon application of taxpayer, the Bank provides local customs offices with guarantee letter for electronic payment of customs tariffs and fees, promising that, if the taxpayer fails to pay tariffs and fees with electronic payment within specified periods, the Bank will pay these tariffs and fee on its behalf by the expiration of taxable period.

2. Service Advantages

The product meets the requirement of electronic payment for tariffs and fees, thus reducing the trade cost, improving the efficiency of customs clearance and safeguarding the tax for customers. The customers, customs offices and the bank can intensify their connection and achieve win-win by such cooperation.

3. Applicable Scope

Importer and exporters that need to reduce financial expenditures and improve the efficiency of customs clearance.

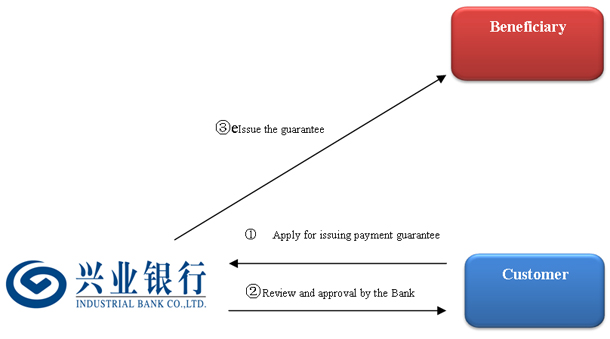

4. Business Procedures

(1) The customers apply to the Bank for guarantee for electronic payment of customs tariffs and fees, and the Bank reviews relevant application materials;

(2) The Bank finishes the review and approve of business;

(3) The Bank issues L/G for electronic payment of customs tariffs and fees;

(4) Upon deduction at expiration of taxable period, if the balance of the customer’s account is insufficient and relevant tariffs and fees are subject to our guarantee for electronic payment, the Bank will pay the insufficient section on behalf of customers;

(5) The customer guarantees to repay the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

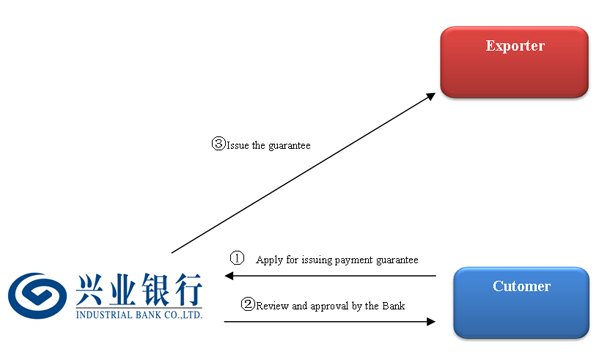

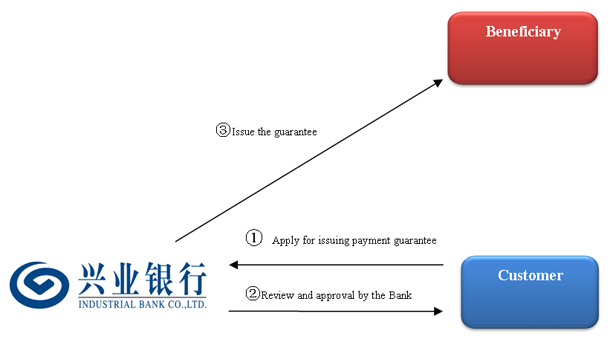

(II) Payment Guarantee

1. Product Definition

Payment guarantee: upon request by the customer (importer) , the Bank issues a guarantee letter to the exporter to guarantee that, after the exporter delivers relevant goods or technological data, which, after inspection, conform to the clauses in contracts, the customer must perform the payment duty in whole or part. Otherwise, the Bank will pay such account payable to the exporters.

2. Service Advantages

(1) It will help the seller or contractor to collect payment for goods or construction in a timely manner for full amount;

(2) The payment condition in payment guarantee may, to some degree, restrict the behavior of the seller/contractor, therefore safeguarding the benefits of the buyer or the owner.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

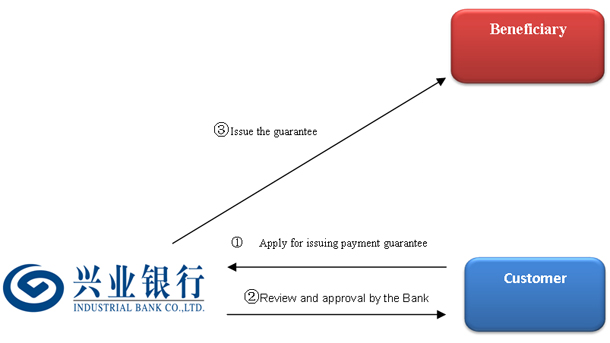

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing payment guarantee;

(2) The Bank conducts the review and approve of business;

(3) The Bank issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

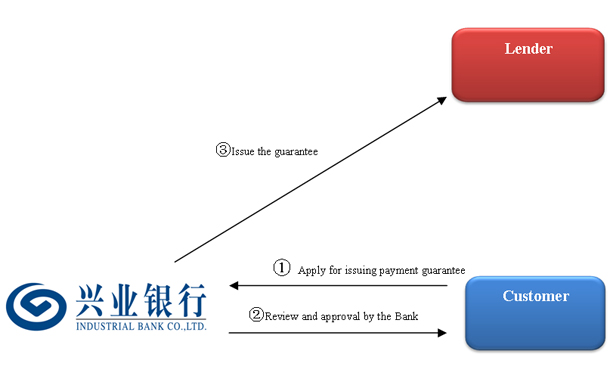

(III) Financing Guarantee

1. Product Definition

Financing guarantee: upon request by the borrower (customer), the Bank, as the guarantor, issues a guarantee letter to guarantee that the borrower will repay the principal and interest of the loan as specified in loan contract to the lender. Should the borrower in default, the guarantor must repay the payable but unpaid amount in whole or part to the lender.

2. Service Advantages

(1) Improve credit evaluation of the borrower to make obtaining financing easier;

(2) Safeguard the loan fund of the lender.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing financing guarantee;

(2) The Bank conducts the review and approval of business, and issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

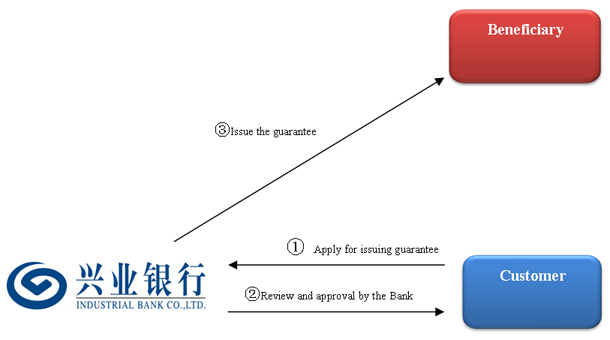

(IV) Retention Money Guarantee

1. Product Definition

Retention money guarantee/final payment guarantee: upon request by the customer (exporter or contractor), the Bank, as the guarantor, issues a guarantee letter in favor of the importer or construction owner, to guarantee that, after early collection of final payment by the customer, if the goods delivered or the construction constructed fail to meet quality standard in relevant contracts, the beneficiary will return such retention money to the importer or construction owner. Otherwise, the Bank will provide compensation.

2. Service Advantages

(1) The rights and interests of the owner after release of the final payment are fully assured;

(2) The contractor may collect the final payment earlier.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing retention money guarantee;

(2) The Bank conducts the review and approve of business;

(3) The Bank issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(V) Performance Guarantee

1. Product Definition

Performance guarantee: upon request by the customer, the Bank, as the guarantor, issues a guarantee letter to guarantee that the customer to perform obligations under specific contract. Should the customer breach the contract within the period of the guarantee letter, the guarantor will pay certain amount of deposit to the beneficiary as required by the guarantee letter. Under import and export trade, performance guarantee generally guarantees the customer (export) to perform delivery obligation under trade contract; under contract work, it generally guarantees the contractor to perform construction project contract.

2. Service Advantages

(1) The rights and interests of the owner are fully assured;

(2) Reduce long term capital tied up for the contractor due to payment of deposit in cash.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing performance guarantee;

(2) The Bank conducts the review and approve of business;

(3) The Bank issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct performance guarantee, and you will be reached by our staff.

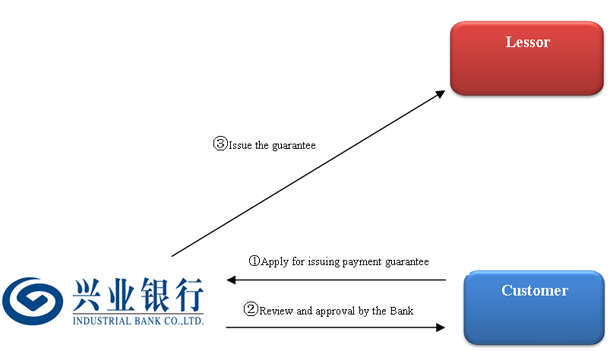

(VI) Guarantee for Financing Lease

1. Product Definition

Guarantee for financing lease: when importing equipments by financing lease, the Bank, as the guarantor, guarantees to the leaser that, if the leasee (customer) fails to pay the rent according to the lease contract, the Bank will pay on behalf of the leasee.

2. Service Advantages

(1) The leaser has the guarantee for timely collection of rent;

(2) It helps the leasee to acquire the right of use on equipments;

(3) It is beneficial for funds accommodation and capital turnover.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing guarantee for financing lease;

(2) The Bank conducts the review and approve of business;

(3) The Bank issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

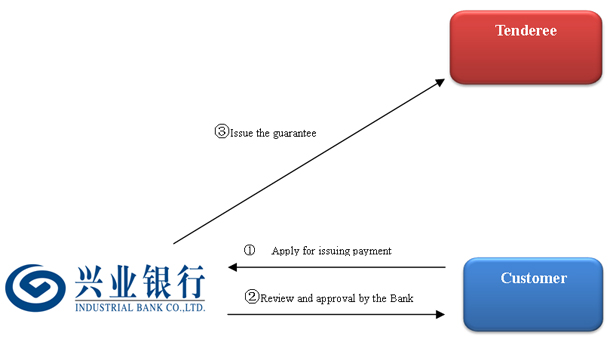

(VII) Tender Guarantee

1. Product Definition

Tender guarantee: upon request by the customer (tenderer), the Bank, as the guarantor, provides written guarantee to the beneficiary (tenderee) that, if the tenderer wins the tender and fails to sign contract, the Bank will pay certain amount of compensation to the beneficiary.

2. Service Advantages

(1) The rights and interests of the tenderee are fully assured;

(2) Improve the market competitiveness of the tenderer.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing tender guarantee;

(2) The Bank conducts the review and approve of business;

(3) The Bank issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

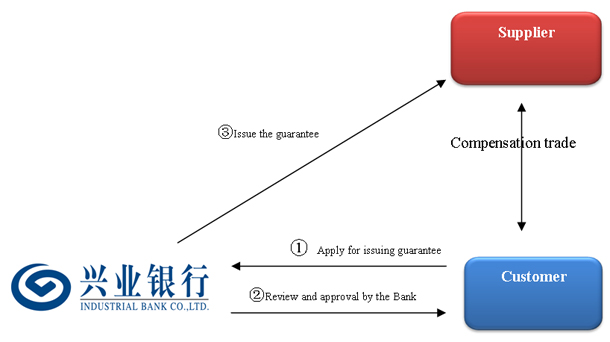

(VIII) Guarantee for Compensation Trade with Spot Exchange Repayment

1. Product Definition

Guarantee for compensation trade with spot exchange repayment: in compensation trade, the Bank, as the guarantor, provides written guarantee letter to the equipments supplier that, if, after the receipt of equipments complying to the contract, the importer (customer) fails to deliver products according to the contract and to make the payment for equipment and attached interest with spot exchange, then the Bank will compensate the equipments supplier.

2. Service Advantages

(1) Solve the mutual distrust between trading parties;

(2) Improve the market competitiveness of the importer.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing guarantee for compensation trade with spot exchange repayment;

(2) The Bank conducts the review and approve of business;

(3) The Bank issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(IX) Advance Payment Guarantee

1. Product Definition

Advance payment guarantee: upon request by the customer, the Bank, as the guarantor, provides written guarantee to the beneficiary that, if, after the receipt of advance payment, the applicant fails to perform the agreement, the Bank will pay such advance payment of corresponding amount to the beneficiary.

2. Service Advantages

(1) Solve the mutual distrust between trading parties;

(2) It is beneficial for timely collection of advance payment.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing advance payment guarantee;

(2) The Bank conducts the review and approve of business;

(3) The Bank issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(X) Quality/Maintenance Guarantee

1. Product Definition

Quality/maintenance guarantee: upon request by the customer (supplier or contractor), the Bank, as the guarantor, provides guarantee letter on the quality of the subject matter of contract that, during certain period of time (warranty period), the goods supplied by the supplier and the construction projects built by the contractor shall meet the specification and quality standard set forth in the contract. If the quality of goods or construction does not comply with the standard in the contract, and the customer is unwilling or refuses to repair, replace or maintain, then the beneficiary of the guarantee (buyer or owner) shall be entitled to claim compensation for its loss from the guarantor.

2. Service Advantages

(1) The rights and interests of the owner and the buyer are fully assured;

(2) Improve the market competitiveness of the contractor and the supplier.

3. Applicable Scope

Domestic enterprises legally established in mainland China with status of a legal person; Overseas based Chinese enterprises approved to invest aboard and to register according to the laws of based countries (regions) and having legal and reliable sources of foreign exchange.

4. Business Procedures

(1) The customer submits relevant application materials to the Bank for issuing quality/maintenance guarantee;

(2) The Bank conducts the review and approve of business;

(3) The Bank issues the guarantee to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

TOP