International Settlement

(I) Inward Remittance

1. Product Definition

The inward remittance means that the Bank accepts the entrustment of an affiliated bank or a correspondent bank to handle payment and remittance to the designated payee.

2. Service Types

The remittance may be made by way of telegraph, mail and draft, and now telegraphic transfer is mainly used.

3. Service Advantages

(1) Low cost. Compared with letter of credit and collection, remittance boasts simple procedures and low cost;

(2) Fast rate. Telegraphic transfer is fast, which is favorable to the exporters to recover funds in a timely manner and accelerate the capital circulation rate.

(3) Easy operation. It is easy and simple to operate and can be applied in a broad range.

4. Applicable Scope

(1) If a customer has a high requirement for capital circulation rate or control of financial cost, it is advisable to choose inward remittance.

(2) The method of remittance is usually adopted for settlement under non-trade and capital account.

5. Business Procedures

(1) The Bank receives the telegraph of remittance instruction sent by a foreign remitting bank;

(2) After checking that the above instruction telegraph is correct and receiving the remittance, the Bank will pay the remittance to the payee.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(II) Export Documentary Collection

1. Product Definition

The export documentary collection is a type of settlement service in which the exporter entrusts the Bank, by presenting the shipping documents, such as draft-attached bill of lading (B/L) and commercial invoices, to the Bank, to collect goods payment from the importer through the collecting bank.

2. Service Advantages

(1) Professional examination of documents enables fast document forwarding;

(2) Easy operation helps lower the cost. Compared with the letter of credit, the handling procedures are simple and easy to go through, so the banking cost is lower;

(3) Control of title of goods helps reduce risks. The importer cannot take the documents and pick up goods until making payment or acceptance. Compared with the method of cash on delivery, the importer bears lower risks.

3. Applicable Scope

It is suitable for exporters having long-term stable business relationships with importers.

4. Business Procedures

(1) Presenting of documents. The customer presents relevant documents to the Bank;

(2) Examination and delivery of documents. After checking relevant documents against the “Liaison Sheet for Documents Presentation by the Customer” and ensuring that they are correct, the Bank will, according to the collection instruction of the exporter, deliver the documents to the designated collecting bank, which will then advice the importer to make payment and acceptance to take such documents;

(3) Receipt and transfer of exchange. After receiving the exchange, the Bank will transfer the funds into the relevant account specified by the exporter and go through relevant formalities for verification and writing-off of export proceeds.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(III) Export Clean Bill Collection

1. Product Definition

The export clean collection means that the payee submits clearing bills, such as bill of exchange, bank note and check, received from abroad, to the Bank (the collecting bank) and entrusts the Bank to collect funds from abroad. Such method of collection is only against bills, and no additional commercial documents are involved, so it is called “clean collection”.

2. Service Types

The export clean collection can be conducted in two ways: cash letter and final credit.

3. Service Advantages

(1) Low cost. The banking charge of clean collection is relatively low;

(2) Security and reliability. Compared with big risks possible to the direct mail collection from the payer, the inter-bank collection via the international network can avoid these risks. It is a relatively safe collection method;

(3) Convenient service. If the remitting bank has entered into the agreement on “cash letter” with the paying/collecting bank, the receiving time can be shortened greatly.

4. Applicable Scope

(1) Small-amount payments for trade and non-trade purposes;

(2) Cash in foreign currency (including worn cash) that cannot be exchanged at home;

(3) Collection service for valuable vouchers including foreign exchange cash, bank notes, foreign bonds and deposit receipts, etc.;

(4) Transactions for which provision of commercial documents impossible or inconvenient, such as those involving hi-tech products like delivering sample and software, those involving seasonal commodities, and intangible ones like service and technology transfer.

5. Business Procedures

(1) The payee submits the collection documents to the Bank;

(2) The Bank delivers the collection documents to the foreign collecting bank for consignment collection;

(3) The foreign collecting bank presents such documents to the payer who will make payment according to the par value;

(4) The foreign collecting bank pays the collected money to the Bank who will make payment to the payee.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(IV) Export L/C Notice

1. Product Definition

Upon receiving the L/C or L/C amendment drawn by a foreign bank, the Bank advises the corresponding beneficiary of the L/C or L/C amendment, after checking the authenticity of the L/C and examining the L/C clauses.

2. Service Advantages

(1) Security. The Bank can provide the beneficiary with services including examination of L/C clauses and inquiry of credit standing of the issuing bank, so as to protect the interests of the beneficiary to the L/C;

(2) Convenience. Offering all-round advice methods such as SMS, e-mail and network, the Bank can ensure that the L/C notified by the Bank can reach the beneficiary within one business day.

3. Applicable Scope

It is applicable to all exporters making settlement by way of L/C.

4. Business Procedures

(1) The Bank examines the L/C;

(2) The Bank advises the beneficiary.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(V) Export L/C Negotiation

1. Product Definition

It is a kind of settlement service in which, after shipment and documentation according to a L/C (not limited to L/C advised by the Bank), the customer submits relevant documents to the Bank, and after examination, the Bank delivers the documents and claim for reimbursement according to the requirements of L/C, and transfer relevant funds into the account designated by the customer after exchange collection.

2. Service Advantages

(1) Professional examination of documents enables fast document forwarding. With documents being handled in a concentrated manner, all documents are examined by experts in the Head Office, so the quality and efficiency of examination can be guaranteed;

(2) With a network reaching the globe, the Bank guarantees the collection of exchange in an efficient and timely manner;

(3) Diversified options make individualized financing possible. Under the export L/C, we can offer different financing products according to the requirements of customers.

3. Applicable Scope

It is applicable to all enterprises that handle export businesses by way of L/C settlement.

4. Business Procedures

(1) Presenting of documents. An exporter stocks up and ship goods, prepare all export documents required under the L/C, and submit such documents to the Bank within the validity of the L/C;

(2) Document examination. After ensuring that the documents are correct through examination, the Bank delivers the documents to the issuing bank or the bank designated by the issuing bank to claim for reimbursement. If there are discrepancies in the documents, the Bank shall contact the exporter to replace or amend relevant documents. If no change can be made, the documents may be delivered after such discrepancies are confirmed by the exporter;

(3) Delivery of documents. Claim for reimbursement to the issuing bank or the reimbursing bank designated by the issuing bank according to the route and method for claiming for reimbursement as specified in the L/C;

(4) Receipt and transfer of exchange. After receiving the exchange, the Bank will transfer the funds into the relevant account specified by the exporter and go through relevant formalities for verification and writing-off of export proceeds.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(VI) Outward Remittance

1. Product Definition

The outward remittance refers to the service that the Bank, under the entrustment of a customer, forwards funds denominated in foreign currency to the bank account of the payee designated by the remitter through our intermediary bank abroad.

2. Service Advantages

As a member of the Society for Worldwide Inter-bank Financial Telecommunication (SWIFT), the Bank has opened accounts of various foreign currencies such as USD, HKD, JPY, EUR, SGD, CAD, CHF, AUD and GBP, so payees can receive funds easily and quickly.

3. Applicable Scope

Customers choosing settlement by way of remittance.

4. Business Procedures

(1) The remitter submits the “Application for Outward Remittance” to the Bank together with relevant documents and vouchers for outward payment in foreign exchange required by the Bank, as well as withdrawal voucher of exchange account, or RMB check for exchange purchase;

(2) After examination, the Bank sends the telegraph of remittance instruction to the foreign correspondent bank;

(3) The foreign correspondent bank pays the remittance to the payee according to the instruction of the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(VII) Import Documentary Collection

1. Product Definition

It is a kind of settlement method in which, serving as the collecting bank, the Bank, under the entrustment of the exporter’s bank (collection bank), presents the documents to the importer for the documents against payment or acceptance, and pays the received funds to the collection bank.

2. Service Advantages

(1) The low banking charge helps to save the financial cost;

(2) With a low ratio of capital tie-up, no advance payment is required at the stages of stock-up and shipment, thus no funds are tied up. After making payment of goods or acceptance, the importer can immediately get the goods documents and handle the goods.

3. Applicable Scope

(1) Importers who hope to make payment of goods to exporters in a way that is easier with lower cost compared with L/C;

(2) If an importer has sufficient working capital, it is advised to choose the way of documents against payment (D/P);

(3) If an importer needs the financing convenience of forward payment from the exporter due to its insufficient working capital and has established a good partnership with the exporter, it is advised to choose the way of documents against acceptance (D/A).

4. Business Procedures

(1) After stocking up and shipping goods, the foreign exporter submits relevant documents to its bank for collection;

(2) The exporter’s bank delivers the collection documents to the Bank, and then the Bank advises the importer of documents against payment (D/P) or documents against acceptance (D/A) according to relevant instructions;

(3) After making payment or acceptance to the exporter via the Bank, the importer can receive the above documents from the Bank;

(4) Upon the maturity of acceptance under D/A, the importer makes payment to the exporter via the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

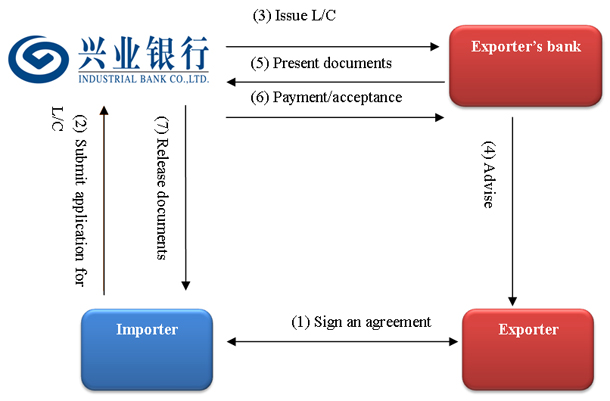

(VIII) Import L/C

1. Product Definition

The import L/C is a kind of payment commitment that the Bank makes to a foreign exporter upon the application of an importer and with which the Bank promises to perform the payment obligation to the exporter if all terms and conditions specified in the L/C are met.

2. Service Advantages

(1) Improving your negotiation position. To open a L/C, it is equivalent to provide a conditional payment commitment to the exporter in addition to commercial credit. With your credit enhanced, you can bargain a more reasonable price for the goods concerned based on the L/C;

(2) Reducing your trade risks. Changing commercial credit into bank credit gives more guarantee to the trading activities.

3. Applicable Scope

(1) The exporter requires settlement by way of L/C;

(2) Both the importer and exporter hope to take the bank credit as the credit intermediary for commercial transactions;

(3) Both the importer and exporter hope to solve the problem of capital tie-up with the trade financing offered by a bank by way of L/C settlement.

4. Business Procedures

(1) The importer and the exporter enter into a sales contract and specify L/C as the settlement method;

(2) The importer submits the “Application for L/C”, “Letter of Commitment”, duplicate of import/export contract and other relevant documents to the Bank to apply for issuing a L/C (including various L/Cs such as sight and forward);

(3) The Bank issues the L/C to the exporter’s bank;

(4) After receiving the L/C, the exporter’s bank advises the exporter;

(5) The exporter’s bank delivers relevant documents to the Bank;

(6) After confirming that the documents conform to the terms and conditions of the L/C, the Bank pays exchange and makes payment to the exporter’s bank;

(7) The Bank advises the customer to go through the formalities for releasing documents so that the customer can take delivery.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(IX) Multi-currency Clearing

1. Product Profile

In order to meet the individualized receipt and payment needs of customers in different currencies, the Bank can do clearing in minor currencies (non-mainstream currencies characterized by small business volume and low frequency) through the clearing bank. The Bank has opened the clearing services (exchange receipt and payment) for converting the clearing accounts in USD and EUR into minor currencies.

2. Product Features

(1) Payment can be made to 160 countries by converting over 20 basic currencies into more than 100 currencies.

(2) In addition to reducing the banking service cost, it can also improve efficiency of cross-border remittance in foreign currency significantly.

3. Business Procedures

Document to be submitted to the Bank include the application for remittance, remittance information, and letter of confirmation on exchange rate, etc.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(X) Full-value Remittance Express

1. Product Profile

The full-value remittance express refers to the remittance service that the Bank helps realize the full-value arrival of the remitted money when a customer handles the outward remittance with the Bank.

2. Product Features

Security, reliability, efficiency, and locked amount of remittance.

3. Business Procedures

The customer fills in the “Application for Home/Abroad Remittance”, applies for the full-value remittance and submits all documents required, and relevant fees will be charged according to the requirements of the correspondent bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(XI) IB E-customs Clearance

1. Product Profile

IB E-customs clearance, namely the electronic payment for customs tariffs and fees, refers to the service that the Bank provides to customers for them to pay the import and export tariffs and fees via the electronic payment system, with a view to improving the efficiency for customers to pay tariffs and go through customs clearance.

2. Advantages

Simple procedure, security and reliability, and non-local real-time payment.

3. Target Enterprises

All enterprises engaging in import and export and needing to pay customs tariffs and fees.

4. Business Procedures

(1) The customer applies to the Bank for the service of E-customs clearance and signs the relevant agreement;

(2) An entrustment relationship is established.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(XII) EasyTrade

1. Product Profile

EasyTrade means that, relying on the EasyTrade system on the corporate internet banking, the Bank offers a range of services to customers including online application, business notification and expert consulting for international settlement, trade financing, foreign currency exchange, and other relevant businesses.

2. Advantages

(1) Complete functions: online business application and notification of handling result are available for various international businesses such as remittance, letter of credit, collection, letter of guarantee, trade financing, foreign currency exchange;

(2) Leading efficiency: online submission of business application and real-time receipt of handling result greatly improve the business handling efficiency;

(3) Menu customization: Customers can customize individualized menus and functions according to their own needs.

3. Target Customers

Corporate customers of the Bank engaging in import and export, and other banks for which the Bank serves as an agency of international businesses and their customers.

4. Main functions

Applications for businesses including issue of L/C, modification of L/C, acceptance/payment/dishonor, collection for import, letter of guarantee, remittance, trade financing, and foreign currency exchange; inquiry of common international businesses such as export L/C notice.

5. Business Procedures

If an enterprise has activated the internet banking of the Bank, it is only required to apply for activating the service of EasyTrade; if not, it is required to apply for the internet banking and then the service of EasyTrade.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(XIII) International Service Agency

1. Product Profile

The international service agency is the agency service for international businesses offered by the Bank targeting at small and medium financial institutions (including banks and finance companies), covering the agency service for international settlement as well as credit enhancement, trade financing and foreign exchange settlement and sale which are developed from the agency service.

2. Advantages

(1) Businesses of small and medium financial institutions for which the Bank can serve as an agency include international settlement, credit enhancement, trade financing and foreign exchange settlement and sale;

(2) Small and medium financial institutions can provide customers with services regarding international businesses via the Bank, thus retaining their customers.

3. Target Customers

Small and medium financial institutions at home that need to handle foreign exchange service with the Bank serving as an agency.

4. Business Procedures

(1) Small and medium financial institutions enter into cooperation agreement with the Bank;

(2) If an institution requires credit enhancement and trade financing, the institutional credit line must be approved by the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(XIV) NRA account

1. Product Profile

Known as NRA (NON-RESIDENT ACCOUNT), an account opened by an institution which was legally incorporated and registered overseas (including Hong Kong, Macao and Taiwan) and which has good existing records and is in normal operation.

2. Product Features

(1) An enterprise can provide account services for overseas customers at domestic branches, which is easy for management of corporate capital;

(2) Simple procedure of settlement and increased efficiency;

(3) To handle settlement via a RMB NRA account, an enterprise can help customers to avoid the risk regarding exchange rate efficiently and guarantee their corporate incomes.

3. Target Customers

(1) Overseas registered enterprises, including overseas registered Chinese investment enterprises;

(2) Overseas registered banks, including its overseas branches;

(3) Overseas registered non-banking financial institutions, including its overseas branches;

(4) Social groups and international organizations.

4. Business Procedures

Submit application documents for account opening → go through the formalities for company investigation (to check the legal and valid existence of the enterprise) → the Bank examines the account-opening documents and goes through relevant formalities → approval of local PBC branch (if necessary) → open account.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

TOP