Receivables

(I) Domestic Factoring

1. Product Definition

Domestic factoring is a series of comprehensive financial services, including subsidiary ledger management of accounts receivable, accounts receivable based financing, collection of accounts receivable and assuming credit risks of buyers, provided by the Bank to sellers resulted from transfer of accounts receivable that is generated from credit sale on domestic trade of sellers.

2. Service Types

(1) Depending on whether the transfer of creditor’s right is notified to the buyer, there are disclosed factoring and undisclosed factoring;

(2) Depending on whether financing is provided to the seller, there are financing based factoring and non-financing based factoring;

(3) For the financing based factoring, depending on whether the right to recourse is retained against the seller, there are domestic factorings with recourse and without recourse.

3. Service Advantages

(1) Transfer accounts receivable to bank, thus expediting capital return and optimizing financial statement;

(2) Bank provides accounts receivable management service to increase financial efficiency and improve customer relationship;

(3) Meet multiple requirements with flexible financing method, including bank acceptance note, commercial acceptance bill discounting, working capital loan and domestic letter of credit.

4. Applicable Scope

(1) Comprehensive financial services, including financial management, collection of accounts receivable, assuming credit risks of the buyer. Enterprises that sell products or deliver services on credit in domestic trade, and the payment term is usually less than 360 days (inclusive);

(2) There is stable and on-going trade relation between the buyer and the seller.

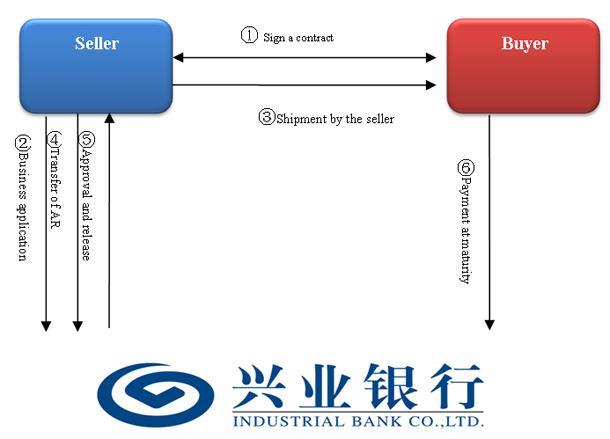

5. Business Procedures

(1) The buyer and the seller conclude and sign Purchase and Sales Contract (the seller may inform the buyer of its intention to conduct factoring during business negotiation, so the buyer may provide relevant information to the Bank);

(2) The seller applies for domestic factoring based financing andthe Bank processes the application;

(3) The seller ships the goods, resulting in accounts receivable;

(4) The seller submits business contracts, invoices and other documents to conduct the transfer of accounts receivable;

(5) Upon approval of the Bank, funds under the financing are released to the seller;

(6) Once accounts receivable become mature, the buyer pays the price of goods to the Bank, and the money will be used to repay the funds under financing previously released to the seller from the Bank (the Bank will transfer the balance into the seller’s account after the principal and interest under the financing are deducted).

Please call our customer service hotline 95561 or contact local branches to conduct domestic factoring, and you will be reached by our staff.

(II) Credit Extension Secured by Pledge of Accounts Receivable

1. Product Definition

The credit extension secured by pledge of accounts receivable: the seller pledges its accounts receivable from domestic trade to the Bank, and the Bank provides it with financing services.

2. Service Advantages

(1) The seller pledges accounts receivable to gain financing facilities, vitalize accounts receivable, and alleviate capital pressure caused by credit sale;

(2) Meet multiple requirements with flexible financing method, including bank acceptance note, commercial acceptance bill discounting, working capital loan and domestic letter of credit.

3. Applicable Scope

(1) Enterprises that sell products or deliver services on credit in domestic trade, and the payment term is usually less than 360 days (inclusive);

(2) There is stable and on-going trade relation between the buyer and the seller.

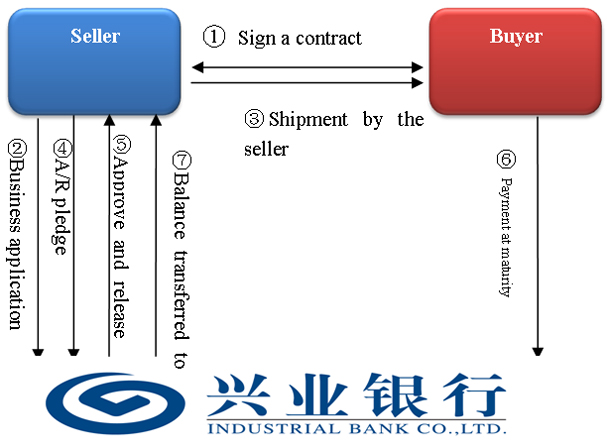

4. Business Procedures

(1) The buyer and the seller conclude and sign Purchase and Sales Contract;

(2) The seller applies for accounts receivable financing pledge, and the Bank evaluates the quota;

(3) The seller ships the goods, resulting in accounts receivable;

(4) The seller submits business contracts, invoices and other documents to conduct the procedure for pledge of accounts receivable;

(5) Upon approval of the Bank, funds under the financing are released to the seller;

(6) Once the accounts receivable becomes mature, the buyer pays the price of goods to the Bank, and the money will be used to repay the funds under financing previously released to the seller from the Bank;

(7) The Bank will transfer the balance into the seller’s account after the principal and interest under the financing are deducted.

Please call our customer service hotline 95561 or contact local branches to conduct credit extension secured by pledge of accounts receivable, and you will be reached by our staff.

(III) Credit Extension Secured by Pledge of Accounts Receivable under Domestic Credit Insurance

1. Product Definition

Credit extension secured by pledge of accounts receivable under domestic credit insurance: under the premise that the seller has covered credit insurance on domestic trade, it pledges its accounts receivable from domestic trade to the Bank and transfers the indemnity rights under domestic credit insurance policy to the Bank, and the Bank provides it with financing services.

2. Service Advantages

(1) Lower the non-payment risk from the buyer and enable the pledge of accounts receivable by credit enhancement from insurance company;

(2) The seller pledges accounts receivable to gain financing facilities, vitalize accounts receivable, and alleviate capital pressure caused by credit sale;

(3) Meet multiple requirements with flexible financing method, including bank acceptance note, commercial acceptance bill discounting, working capital loan and domestic letter of credit.

3. Applicable Scope

(1) Comprehensive financial services, including financial management, collection of account receivable, assuming credit risks of the buyer. Enterprises that sell products or deliver services on credit in domestic trade and have covered credit insurance on domestic trade, and the payment term is usually less than 360 days (inclusive);

(2) There is stable and on-going trade relation between the buyer and the seller.

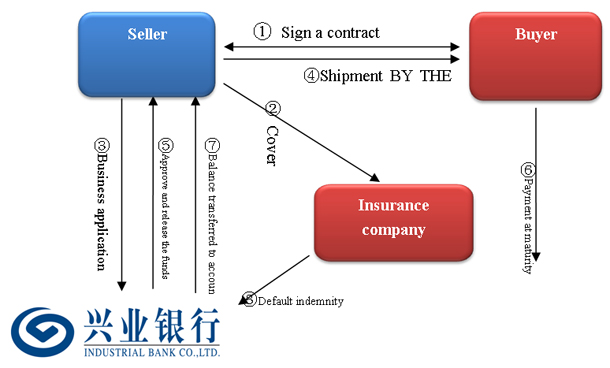

4. Business Procedures

(1) The buyer and the seller conclude and sign Purchase and Sales Contract;

(2) The seller covers credit insurance on domestic trade;

(3) The seller applies for financing, and the Bank evaluates the quota;

(4) The seller ships the goods, resulting in accounts receivable, and submits business contracts, invoices and other documents to conduct the procedure for pledge of accounts receivable;

(5) Upon approval of the Bank, funds under the financing are released to the seller;

(6) Once the accounts receivable becomes mature, the buyer pays the price of goods, and the money will be used to repay the funds under financing previously released to the seller from the Bank;

(7) The Bank will transfer the balance into the seller’s account after the principal and interest under financing, and related fees are deducted;

(8) Should the buyer be in default, the insurance company indemnifies the Bank according to the agreement.

Please call our customer service hotline 95561 or contact local branches to conduct credit extension secured by pledge of accounts receivable under domestic credit insurance, and you will be reached by our staff.

(IV) Credit Extension Secured by Pledge of Lease Payment

1. Product Definition

Credit extension secured by pledge of lease payment: the lessor pledges its lease payment receivable to the Bank, and the Bank provides it with financing services

2. Service Advantages

(1) The lessor pledges lease payment receivable to gain financing facilities, vitalize lease payment receivable, and alleviate capital pressure caused by long capital recovery period;

(2) Meet multiple requirements with flexible financing method, including bank acceptance note, commercial acceptance bill discounting, working capital loan and domestic letter of credit.

3. Applicable Scope

(1) The lease term is generally not longer than 3 years, or 5 years at longest.

(2) The business scope of the lessor includes leasing, and the lessor maintains stable and good cooperation with the lessees.

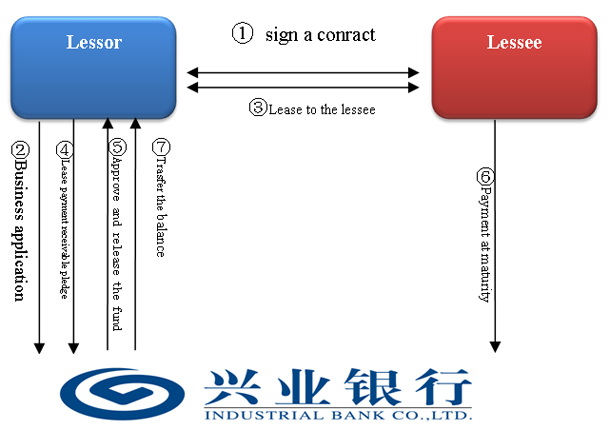

4. Business Procedures

(1) The lessor and the lessee conclude and sign lease contract;

(2) The lessor applies for financing from the Bank, and the Bank evaluates the quota;

(3) The lessor lease to the lessee;

(4) The lessor submit related documents to conduct the procedure the pledge of lease payment receivable , thus pledging the lease payment receivable to the Bank;

(5) The Bank extends the loan to the lessor after approval;

(6) The lessee pays the rent to the Bank at maturity as repayment of the funds under financing received by the lessor;

(7) The Bank will transfer the balance into the lessor’s account after the principal and interest under financing, and related fees are deducted;

Please call our customer service hotline 95561 or contact local branches to conduct credit extension secured by pledge of lease payment, and you will be reached by our staff.

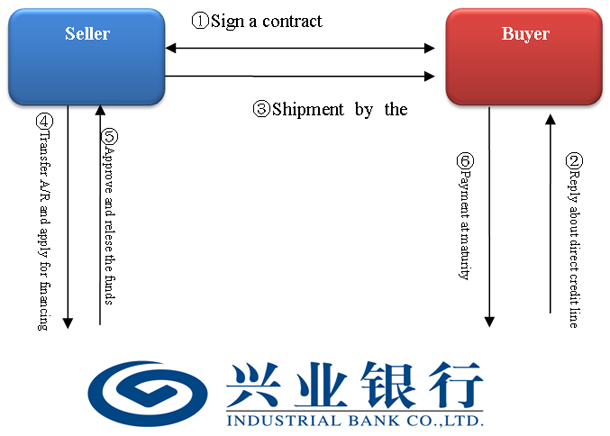

(V) Credit Extension Secured by Domestic Reverse Factoring

1. Product Definition

Credit extension secured by domestic reverse factoring: under trade with credit sale as payment method and no dispute about underlying trade and accounts receivable, the Bank provides the seller with accounts receivable financing without recourse, provided that the buyer’s direct credit line in the Bank is utilized accordingly.

2. Service Types

Depending on the difference of initiator and data provider, there are buyer application model and seller agency model.

3. Service Advantages

(1) Featured on utilizing credit line.

During the procedure, whether buyer application model or seller agency model, the direct credit line of the buyer is utilized to provide financing to the seller, and the seller does not have to apply for credit additionally.

(2) Flexible way to initiate.

Both the buyer and the seller can be the initiator, and depending on the difference of initiator and data provider, there are buyer application model and seller agency model.

(3) Simple procedure.

The domestic reverse factoring saves the procedure for credit line evaluation for the seller, thus shortening the time from product marketing to implementation. It is especially convenient and simple for those buyers that already have credit lines as the business is ready to begin directly.

4. Applicable Scope

(1) Comprehensive financial services, including financial management, collection of account receivable, assuming credit risks of the buyer. Enterprises that sell products or deliver services on credit in domestic trade, and there is stable and on-going trade relation between the buyer and the seller;

(2) The buyer has direct credit line in the Bank, and wishes to help upstream seller to solve financing difficulties.

(3) It is especially fit for multiple dispersed SME seller of one large quality customer to apply.

5. Business Procedures

(1) The buyer and the seller conclude and sign Purchase and Sales Contract;

(2) The buyer applies for or increases the direct credit line of domestic reverse factoring in the Bank;

(3) The seller ships the goods, resulting in account receivable;

(4) The seller submits business contracts, invoices and other documents to conduct the transfer of account receivable;

(5) The Bank, after approval, releases the funds to the seller by utilizing direct credit line of the buyer;

(6) Once accounts receivable become mature, the buyer pays the price of goods to the Bank, and the money will be used to repay the funds under financing previously released to the seller from the Bank (the Bank will transfer the balance into the seller’s account after the principal and interest under the financing are deducted).

Please call our customer service hotline 95561 or contact local branches to conduct domestic factoring, and you will be reached by our staff.

TOP