Others

(I) Domestic Letter of Credit

1. Product Definition

Domestic letter of credit: upon application by the applicant (the buyer), issuing bank makes payment promise with bills that meet L/C provisions. Domestic letter of credit is an irrevocable and nontransferable documentary L/C, with RMB as the settlement currency.

2. Service Types

(1) Settlement: issuing, notice and consignment collection.

(2) Financing:

(1) buyer financing

●Domestic L/C- credit extension and issuing L/C

●Domestic L/C-buyer hypothecation

(2) Seller financing

●Domestic L/C-package loan

●Domestic L/C-negotiated payment

●Domestic L/C-accounts receivable discount

●Domestic L/C-seller hypothecation

●Domestic L/C-forfeiting

3. Service Advantages

Integrate settlement and financing, and provide diversified financing products.

(1) Advantages to buyers

(1) Buyer makes payment against documents and keeps the payment safe;

(2) Deferred payment L/C allows certain payment days to the buyer;

(3) The buyer may apply for buyer financing such as domestic L/C-buyer hypothecation, thus gaining financing convenience.

(2) Advantages to sellers

(1) Keep the payment safe with the help from bank credit;

(2) The seller may apply for seller trade financing such as domestic L/C negotiated payment, accounts receivable discount or forfeiting, thus collecting capital in advance.

4. Applicable Scope

Domestic trade settled in RMB.

5. Business Procedures

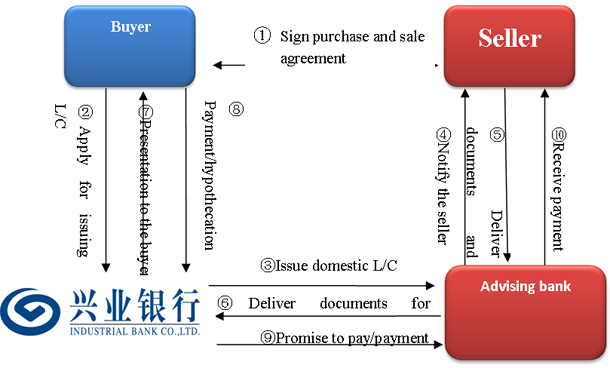

(1) Procedures for buyer

(1) The buyer and the seller sign purchase and sale agreement, and agree on settlement with L/C;

(2) The buyer (applicant) applies to the Bank for issuing domestic L/C;

(3) The Bank issues domestic L/C;

(4) The advising bank notifies the domestic L/C to the seller;

(5) The seller delivers the documents required by the domestic L/C for consignment collection;

(6) The advising bank sends the documents to the Bank;

(7) The Bank presents for payment or acceptance by the buyer;

(8) The buyer agrees to pay or applies for buyer hypothecation or other business;

(9) The Bank promises to pay/makes the payment under L/C;

(10) The advising bank transfers the payment into the seller's account.

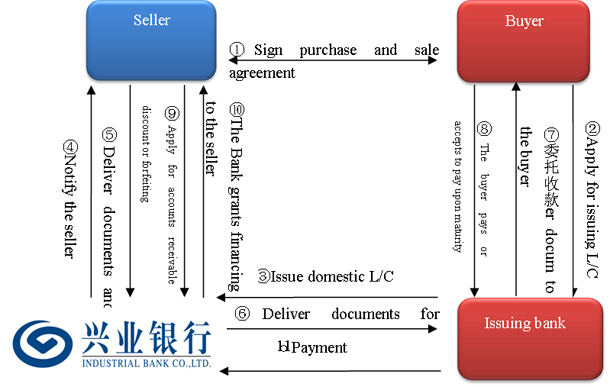

(2) Procedures for seller

(1) The buyer and the seller sign purchase and sale agreement, and agree on settlement with L/C;

(2) The buyer (applicant) applies to issuing bank for issuing domestic L/C;

(3)The issuing bank issues domestic L/C;

(4) The Bank notifies the domestic L/C to the seller;

(5) The seller deliver the documents required by the domestic L/C to the Bank for consignment collection; applies to the Bank for negotiated payment or seller hypothecation;

(6) The Bank verifies the documents and sends them to issuing bank;

(7) The issuing bank presents the documents to the buyer;

(8) The buyer pays or promises to pay upon maturity;

(9) The seller applies to the Bank for conducting accounts receivable discount or forfeiting;

(10) The Bank grants financing to the seller;

(11) The buyer’s bank makes the payment which will be used to repay funds under financing from the Bank (the Bank will transfer the balance into the seller’s account after deduction of the principal and interest under financing).

Please call our customer service hotline 95561 or contact local branches to conduct domestic L/C, and you will be reached by our staff.

TOP