Inventory

(I) Credit Extension Secured by Pledge of Movables

1. Product Definition

Credit extension secured by pledge of movables: the customer or third party pledges to the Bank with legally owned movables which will be possessed and supervised by a supervisor as appointed by the Bank, and the Bank will release funds under financing as a result.

2. Service Types

(1) Specific deal controlled model: release funds under financing based on control of movables in specific deal;

(2) Total quantity controlled model: control the minimum of movables, and any excessive part may be used for replacing or picking up goods, and operation is very convenient.

3. Service Advantages

(1) Vitalize inventories, and solve the problem of capital tie-up;

(2) Meet multiple requirements with flexible financing method, including bank acceptance note, commercial acceptance bill discounting, working capital loan and domestic letter of credit.

4. Applicable Scope

(1) Manufacturing or trading enterprises engaged in manufacture or sale of bulk raw material, basic products or other goods, and capital is tied up because of massive inventories;

(2) The customer (or third party) has legal title to movables.

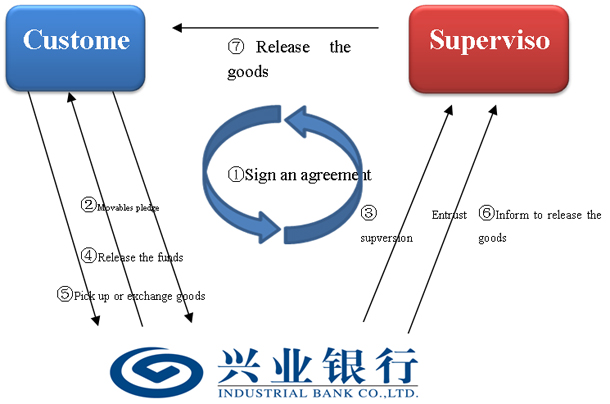

5. Business Procedures

(1) The customer (or third party), the supervisor and the Bank conclude and sign cooperation agreement;

(2) The customer pledges its movables to the Bank;

(3) The Bank entrusts the supervisor to supervise the goods;

(4) The Bank releases funds under financing to the customer;

(5) The customer supplements deposit to the Bank to pick up goods or exchange goods with goods;

(6) The Bank informs the supervisor to release the goods;

(7) The supervisor releases the goods to the customer.

Please call our customer service hotline 95561 or contact local branches to conduct credit extension secured by pledge of movables, and you will be reached by our staff.

(II) Import L/C for Goods Control

1. Product Definition

Import L/C for goods control: upon application from the importer, and based on effective control of future property in goods under letter of credit, the Bank waives part of deposits for issuance of L/C.

2. Service Types

Depending on the type of import L/C, the financing needs of importers and sales model of imported goods, there are three models including payment upon arrival of shipping documents, converting into pledge of movables upon arrival of goods and closed payback of domestic sale.

3. Service Advantages

(1) Improve the negotiation position. By settling with L/C, and converting business credit into bank credit, the importer may improve its position in negotiation.

(2) Less capital tied up. Based on future property in goods, part of deposits for issuance of L/C is waived by the bank for the importer who may conduct subsequent financing with less capital tied up.

(3) Multiple procedures and models. The importer may choose from multiple models as necessary.

4. Applicable Scope

(1) Settle with L/C.

(2) The imported goods are recognized by the Bank.

5. Business Procedures

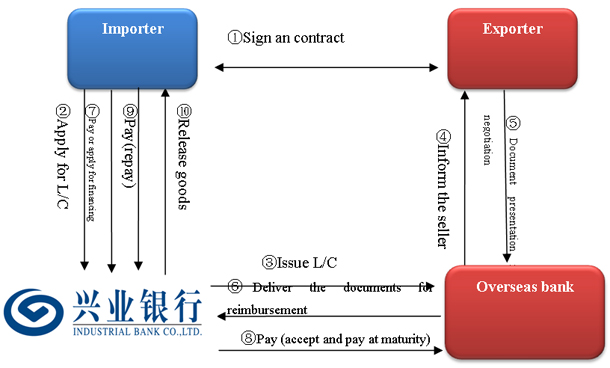

(1) The importer and the exporter sign purchase and sale agreement, and agree on settlement with L/C;

(2) The importer applies for issuance of import L/C secured by pledge of future property in goods to the Bank;

(3) The Bank issues import L/C as required by the importer;

(4) Overseas bank informs the exporter of the L/C;

(5) The exporter delivers the documents for negotiation;

(6) Overseas bank delivers the documents to the Bank;

(7) The Bank advises the importer to pay or accept, and the importer pays by itself or applies for financing;

(8) The Bank makes the outbound payment (or accepts and pays at maturity);

(9) The importer pays (repays);

(10) The Bank/the supervisor releases the documents/goods.

Please call our customer service hotline 95561 or contact local branches to conduct import L/C for goods control, and you will be reached by our staff.

(III) Credit Extension Secured by Pledge of Hedging Movables/Warehouse Receipts

1. Product Definition

Credit extension secured by pledge of hedging movables/warehouse receipts: the customer pledges its legally owned movables or warehouse receipts to the Bank, and establishes equivalent hedging sell-position of pledged movables or warehouse receipts on amount and quality in a futures company as appointed by the Bank, thus applying for short term financing to the Bank.

2. Service Types

(1) Credit extension secured by hedging warehouse receipts: the pledged properties are standard warehouse receipts.

(2) Credit extension secured by hedging movables: the pledged properties are mature products listed on three major exchanges, and the quality meets the delivery standard of corresponding items on such exchanges.

3. Service Advantages

(1) High pledge rate, effectively vitalize the inventory capital of the customers.

(2) Convenient procedure, and make no change to customer’s business model.

(3) Meet multiple requirements with flexible financing method, including bank acceptance note, commercial acceptance bill discounting, working capital loan and domestic letter of credit.

4. Applicable Scope

(1) Manufacturing or trading enterprises engaged in manufacture or sale of futures exchanges traded items and hedged relevant items, while its capital is tied up because of too much inventory;

(2) The customers have legal title to movables.

5. Business Procedures

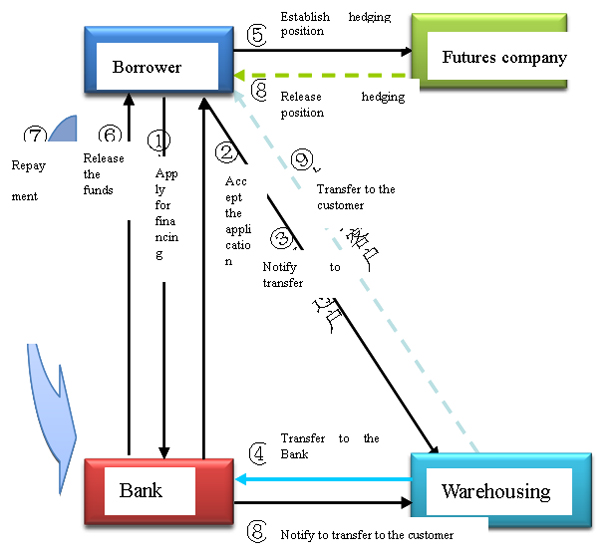

Chart 1. Business Procedures for credit extension secured by hedging movables

1、The customer applies to the Bank and obtains credit extension;

2、The customer, the Bank and the futures company sign tripartite agreement on the supervision of futures hedging and contract on opening futures account, and warehousing contract with warehousing company;

3、The customer delivers the goods into the warehouse;

4、The customer issues Delivery Order for XX company, and the delivery warehouse transfers the goods to the Bank;

5、The customer establishes corresponding hedging position on its futures account in the futures company;

6、The bank extends the loan, and the customer receives off-site financing of 90% pledge rate;

7、The customer repays the funds;

8、The Bank issues Delivery Order of IB, and releases the supervision on pledge and hedging position;

9、The warehouse transfers the goods to the customer.

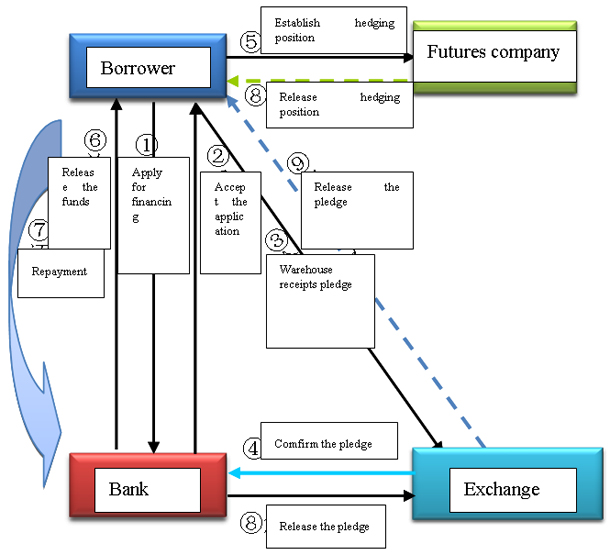

Chart 2. Business Procedures for credit extension secured by pledge of hedging warehouse receipts

1、The customer applies to the Bank and obtains credit extension;

2、The customer, the Bank and the futures company sign tripartite agreement on the supervision of futures hedging and contract on opening futures account;

3、The customer applies to pledge the electronic warehouse receipts in the exchange to the Bank;

4、The Bank confirms the pledge in the exchange;

5、The customer establishes corresponding hedging position on its futures account in the futures company;

6、The bank extends the loan, and the customer receives off-site financing of 90% pledge rate;

7、The customer repays the funds;

8、The Bank informs the exchange to release the supervision on pledge and hedging position;

9、The exchange releases the pledge in its system.

Please call our customer service hotline 95561 or contact local branches to conduct credit extension secured by pledge of movables, and you will be reached by our staff.

TOP