Fund Transaction

(I) Spot Foreign Exchange Settlement and Sale

1. Product Profile

Spot foreign exchange settlement and sale: based on foreign exchange administration policies and demands of customers, the Bank conducts exchange business between RMB and freely convertible foreign currency at certain exchange rate. Foreign exchange settlement: convert foreign currency into RMB. Foreign exchange purchase: convert RMB into foreign currency.

2. Product Features

(1) Meet customer’s demand of currency exchange in trade, investment and debts;

(2) Multiple currencies trading is available based on real time price on foreign exchange market.

3. Target Customers

Domestic organization or individual that meet the national foreign currency administration policies and can conduct spot foreign exchange settlement and sale.

4. Business Procedures

(1) Open account: to conduct spot foreign exchange settlement and sale, the customer will have to open corresponding foreign currency and RMB account.

(2) Review of authorization: except for those specially agreed, the customer has to submit application for foreign exchange settlement (agency approval form) or application for purchase and/or payment of foreign exchange (agency approval form).

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(II) Forward Foreign Exchange Settlement and Sale

1. Product Profile

Forward foreign exchange settlement and sale: the customer signs contract for forward foreign exchange settlement and sale with the Bank after negotiation, and agrees on the currency, amount, exchange rate and delivery date subject to forward settlement and sale; at the delivery date, the customer must sell the foreign currency according to the currency, amount and exchange rate set forth in such contract.

Period: fixed term and optional term.

There are 14 levels of standard term for forward foreign exchange settlement and sale: 7 days, 21 days, 1 month, 2 months, 3 months, 4 months, 5 months, 6 months, 7 months, 8 months, 9 months, 10 months, 11 months and 12 months, which are adjustable according to the business development.

Currency included in this business: currencies listed for trading in the Bank and those can be transacted after enquiry with the capital operation center of HQ (including but not limited to USD, HKD, EUR, JPY, GBP, AUD and CAD).

2. Product Features

(1) Lock in current cost or future revenue for enterprises, avoid risk in exchange rate;

(2) Agree on future exchange rate in advance, and maintain the value of currency.

3. Target Customers

The enterprises that wish to lock in the exchange rate for forward foreign exchange settlement and sale.

4. Business Procedures

(1) Sign the master agreement

(2) Authorize the Bank to conduct single transaction.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(III) Foreign Exchange Trading

1. Product Profile

Agency foreign exchange trading: upon demand of institutional customers (including companies and institutional customers) on receipt and payment of foreign exchange and maintain value of exchange rate in international trade, the Bank buys one currency with another currency in international market on behalf of institutional customers.

2. Product Features

(1) Adjust combination of foreign exchange and disperse the risk in exchange rate;

(2) Achieve value maintenance and increase of foreign exchange in international trade settlement, overseas investment, loan or repayment of foreign exchange

3. Target Customers

(1) Customers who need to pay in foreign exchange but the foreign exchange in hand is inconsistent with the payment currency;

(2) Customers who need to adjust combination of foreign exchange and disperse the risk in exchange rate

4. Business Procedures

(1) The customer signs master agreement of agency foreign exchange trading with the Bank

(2) Submit letter of authorization for single transaction of foreign exchange trading

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(IV) RMB and Foreign Exchange Options

1. Product Profile

RMB and foreign exchange options: when conducting option business in bank, the enterprises determine a future trading day as the exercising day, and the option's buyer should be entitled to exercise the option at agreed price on exercising day and pay the principal as set forth in contract. The option's buyer shall pay relevant fees about option.

2. Product Features

(1) Flexible choice: No matter the change of market price at maturity, the customers can at least obtain baseline price, which will be beneficial to achieve diversified allocation of assets under risk protection and better price on the settlement and sales of foreign exchange, with the maximum loss is option fees.

(2) The customers have the option to exercise or not, increasing the flexibility of trading.

3. Target Customers

Enterprises which will receive, pay, settle and sell foreign exchange in the future and need to avoid exchange rate risk of foreign exchange.

4. Business Procedures

(1) The customer signs master agreement with the Bank;

(2) Authorize the Bank to conduct single transaction.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(V) RMB and Foreign Exchange Swap

1. Product Profile

RMB and foreign exchange swap: customers use currency A (RMB or foreign exchange) to exchange currency B, and on a specific future date, use currency B to change back currency A of same amount on agreed exchange rate.

2. Product Features

(1) Avoid risk in exchange rate. If the customer currently has currency A but need currency B, and after a period of time, it receives currency B and converts back into currency A, then the customer can conduct RMB and foreign exchange swap to secure exchange cost, and avoid risk in exchange rate.

(2) Adjust the value date of forward foreign exchange settlement and sale. After conduct forward foreign exchange settlement and sale, if the customer needs to deliver ahead of schedule or is unable to deliver on time because of lacking capital or other reasons and needs to roll over, they can adjust original delivery date by conducting RMB and foreign exchange swap.

3. Target Customers

Enterprises which receive and pay foreign exchange domestically and need to avoid exchange rate risk of foreign exchange

4. Business Procedures

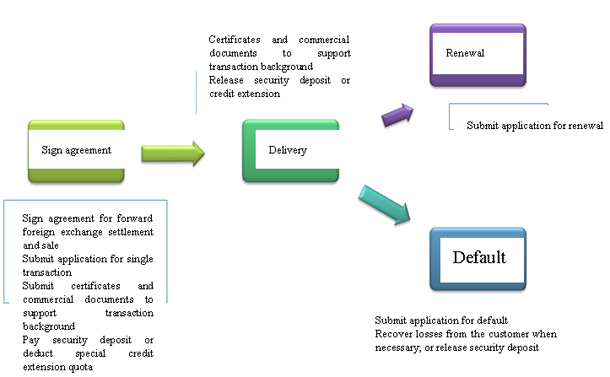

The below chart shows the procedure of RMB and foreign exchange swap.

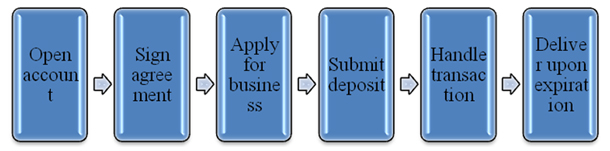

The procedures of customers in conducting RMB and foreign exchange swap in the Bank:

(1) The customer opens RMB and foreign exchange account with the Bank before specific transaction authorization is accepted;

(2) The Bank signs the master agreement of RMB and foreign exchange swap with the customer;

(3) The customer submits application of swap transaction case by case to the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(VI) Interest Rate Swap of Foreign Exchange

1. Product Profile

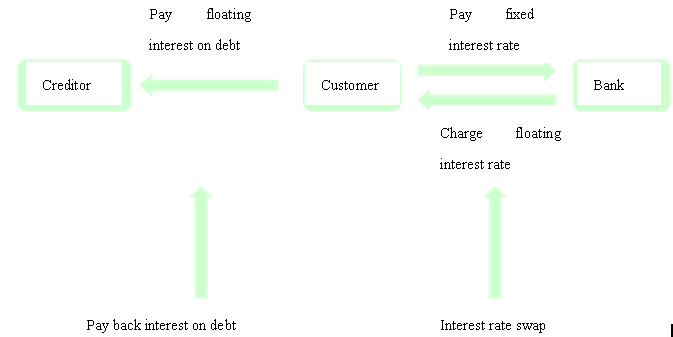

Interest rate swap: According to the interest rate trend on international capital market, the debtor converts its debt with floating interest rate into debt with fixed interest rate, or vice versa. The Interest rate swap involves no exchange of the principal of debt, that is to say, the customer does not have to exchange principal with bank at the beginning and ending of period.

2. Product Features

It helps customer to effectively manage risks in interest rate, lower cost of debt and increase income of assets.

3. Target Customers

The enterprises with loans in foreign exchange.

4. Business Procedures

The below chart shows the procedures of interest rate swap.

(1) Our branch signs Agreement on Agency Derivatives Transaction by IB with the customer.

(2) The customer submits application of interest rate swap transaction case by case to the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

TOP