Pre_payment

(I) Confirmation Warehouse

1. Product Definition

Confirmation warehouse: the Bank signs cooperation agreement with the seller and the buyer, and provides the buyer with financing to meet its capital demand when ordering goods, and the buyer increases deposits or repay the money to apply for picking up goods, and the seller is entrusted to store the goods and to ship the goods as instructed by the Bank.

2. Service Advantages

(1) Advantages to buyers

(1) Enlarge the procurement scale via banking financing, and receive favorable price for bulk procurement;

(2) Meet multiple requirements with flexible financing method, including bank acceptance bill, working capital loan and domestic letter of credit.

(2) Advantages to sellers

(1) Increase sales scale and market share;

(2) Ease sales pressure and accelerate turnover of capital.

3. Applicable Scope

Applicable to the purchase and sale relationship between large enterprises and its downstream buyer.

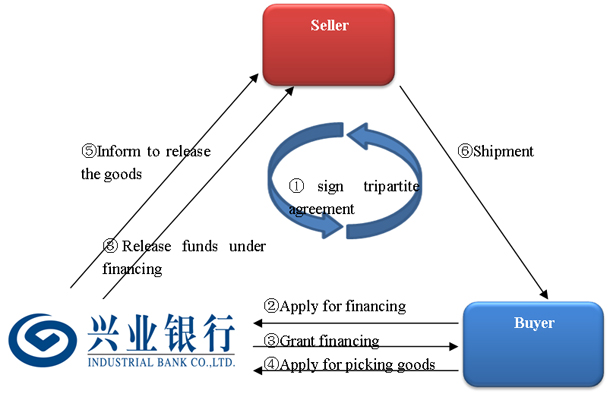

4. Business Procedures

(1) The Bank, the buyer and the seller conclude and sign tripartite cooperation agreement;

(2) The buyer submits financing application to the Bank;

(3) The Bank grants financing to the buyer, and releases the funds to the seller directly;

(4) The buyer supplements deposits or repay the money to apply for picking up goods;

(5) The Bank informs the seller to ship the goods;

(6) Subject to the Bank’s instruction, the seller ships the goods to the buyer.

Please call our customer service hotline 95561 or contact local branches to conduct confirmation warehouse, and you will be reached by our staff.

(II) Manufacturer-distributor-bank Financing

1. Product Definition

Manufacturer-distributor-bank financing: the Bank signs cooperation agreement with the seller, the buyer and the supervisor, provides the buyer with financing to meet its capital demand when ordering goods. Upon arrival at supervision place designed by the Bank, the goods become pledge by movables, and the supervisor is entrusted to store the goods and to ship the goods as instructed by the Bank.

2. Service Advantages

(1) Advantages to buyers

(1) Enlarge the procurement scale via banking financing, and receive favorable price for bulk procurement;

(2) Meet multiple requirements with flexible financing method, including bank acceptance bill, working capital loan and domestic letter of credit.

(2) Advantages to sellers

(1) Increase sales scale and market share;

(2) Ease sales pressure and accelerate turnover of capital.

3. Applicable Scope

Applicable to the purchase and sale relationship between large enterprises and its downstream buyer.

4. Business Procedures

(1) The Bank, the buyer, the seller and the supervisor conclude and sign relevant cooperation agreement;

(2) The buyer submits financing application to the Bank;

(3) The Bank grants financing to the buyer, and releases the funds under financing to the seller directly;

(4) The seller ships the goods to the supervisor upon receipt of payment for goods;

(5) The buyer applies to the Bank for picking up goods;

(6) The Bank informs the supervisor to release the goods;

(7) Subject to the Bank’s instruction, the supervisor releases the goods.

Please call our customer service hotline 95561 or contact local branches to conduct manufacturer-distributor-bank financing, and you will be reached by our staff.

(III) Manufacturer-manufacturer-bank Financing

1. Product Definition

Manufacturer-manufacturer-bank financing: the Bank, the customer, the upstream seller and the downstream buyer sign cooperation agreement, and the Bank provides the customer with financing for purchasing goods from the seller and selling to the buyer, and the seller ships the goods to the buyer according to the agreement, and the buyer makes the payment for goods according to the capital recovery route under the agreement.

2. Service Advantages

(1) Solve the capital shortage for advance payment in purchasing goods from large enterprises, and the capital pressure caused by credit sale.

(2) Meet multiple requirements with flexible financing method, including bank acceptance bill, working capital loan and domestic letter of credit.

3. Applicable Scope

Both the upstream seller and the downstream buyer are large enterprises, where the transaction with the upstream seller (purchase) requires advance payment, and that with the downstream buyer (sell) requires credit sale.

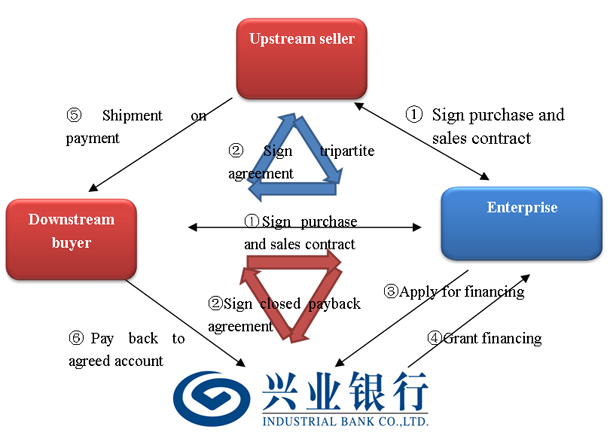

4. Business Procedures

(1) The customers sign purchases and sales contract with the upstream seller and the downstream buyer respectively;

(2) The Bank sign tripartite cooperation agreement with the seller and the customer, and tripartite cooperation agreement on closed payback agreement with the buyer and the customer;

(3) The customer submits financing application to the Bank;

(4) The Bank grants financing to the customer, and releases the funds under financing to the seller directly;

(5) The upstream seller ships the goods to the downstream buyer directly upon receipt of payment for goods;

(6) The buyer makes the payment for goods upon receipt of goods.

Please call our customer service hotline 95561 or contact local branches to conduct manufacturer-manufacturer-bank financing, and you will be reached by our staff.

(IV) Domestic Buyer Credit

1. Product Definition

Domestic buyer credit: the Bank signs cooperation agreement with the seller and the buyer, and RMB loan released in installment repayment will be used by the buyer to purchase production equipment, transportation vehicle and other fixed assets for operation from the seller; under this business, the seller shall assume responsibilities such as unconditional buy-back.

2. Service Types

Depending on the nature of customers, there are individual domestic buyer credit and corporate domestic buyer credit.

3. Service Advantages

(1) Meet the buyer's capital demand for purchasing fixed assets, and reduce repayment pressure by installment repayment;

(2) Help the seller enlarge sales network and increase market share.

4. Applicable Scope

The buyer needs to purchase production equipment, transportation vehicle and other fixed assets required for operation but short in capital, and the seller is willing to assume responsibilities such as unconditional buy-back.

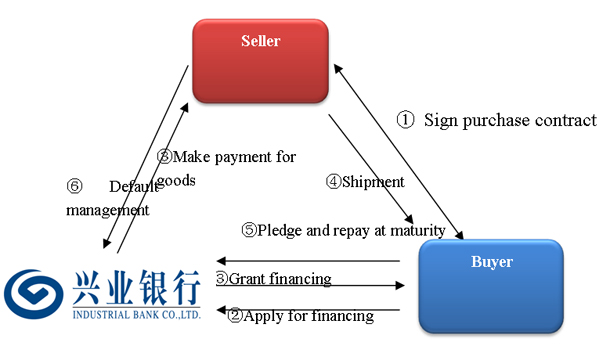

5. Business Procedures

(1) The buyer and the seller conclude and sign Purchase Contract;

(2) The buyer submits financing application to the Bank;

(3) The Bank signs relevant agreement with the buyer and the seller, grants financing to the buyer and releases the funds under financing to the seller directly

(4) The seller ships the goods upon receipt of payment for goods;

(5) The buyer conducts procedure for mortgage and repays financing to the Bank at maturity;

(6) Shall the buyer be in default, the seller performs relevant responsibilities to the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct domestic buyer credit, and you will be reached by our staff.

(V) Seller Guaranteed Buyer Financing

1. Product Definition

Seller guaranteed buyer financing: the Bank signs cooperation agreement with the buyer and the seller, and grants financing to the buyer for capital needs when ordering goods from the seller, provided that the seller assumes joint and several guarantee liabilities.

2. Service Advantages

(1) Meet the buyer's financing demand and help it expand operation scale;

(2) Help the seller enlarge sales and increase market share.

3. Applicable Scope

The buyer needs to expand procurement scale but lack of capital in short term, and the seller is willing to assume joint and several guarantee liabilities to promote sales.

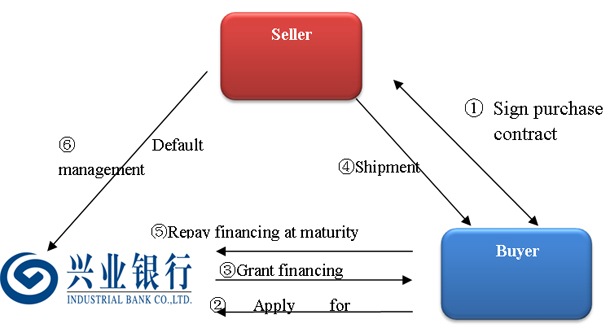

4. Business Procedures

(1) The buyer and the seller conclude and sign Purchase Contract;

(2) The buyer submits financing application to the Bank;

(3) The Bank signs relevant agreement with the buyer and the seller, grants financing and releases the funds under financing to the seller;

(4) The seller ships the goods upon receipt of payment for goods;

(5) The buyer repays the financing;

(6) Shall the buyer be in default, the seller performs relevant responsibilities to the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct seller guaranteed buyer financing, and you will be reached by our staff.

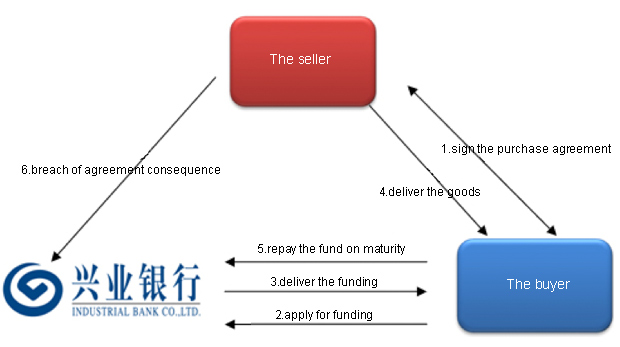

(VI) The sellers guarantee obligation finance

1. Brief introduction of the product

The sellers guarantee obligation finance means, with a cooperation agreement signed by the Industrial Bank, the buyer and the seller, under the circumstances that the seller provides obligation guarantees, the Industrial Bank will provide finance to the buyer for its purchase need from the seller.

2. Products advantages

(1) Meeting the financial needs of the buyer and helping the improvement of its scales.

(2) Helping the seller to expand its sales and market shares.

3. Targeted clients

Buyers with short term fund shortages who are looking for scaling up, and sellers who are willing to promote sales and take guarantee obligations.

4. Business process

① The buyer and seller sign a purchase agreement;

② The buyer apply for funding from our bank;

③ the buyer, seller and us sign the regarding agreement. We release the purchase fund to the seller;

⑤ After receiving the purchase fund, the seller deliver the goods;

⑥ The buyers repay the funds;

⑦ If the buyer's breach the agreements, the sellers shall take the regarding obligation to our bank.

If you are interested in this business, please call our service hotline: 95561, or contact our local branch, we will arrange a meeting with you.

TOP