International Trade Financing

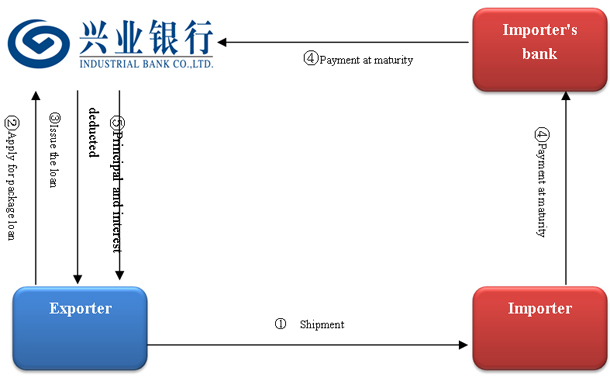

(I) Package Loan

1. Product Definition

Upon application by the exporter, the Bank, based on an original L/C in favor of the exporter, provides the exporter with short term trade financing which will be used for production or purchasing goods under such L/C.

2. Service Advantages

(1) Less capital tied up. It provides the exporter with funds accommodation during production, procurement and other preparation stages, and improves the capital utilization efficiency for the exporter;

(2) Enlarge trade opportunity. When the exporter is short in funds and cannot obtain the term of advance payment, it helps the exporter to conduct business and grasp business opportunity.

3. Applicable Scope

The exporter and the importer settle with L/C; the export is short in working capital.

4. Business Procedures

(1) Accept the application for package loan from the customer;

(2) Issue the loan

(3) The customer prepares and ships the goods;

(4) The importer pays at maturity;

(5) The Bank transfers the balance after deducting the principal and interest of loan into customer’s account.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

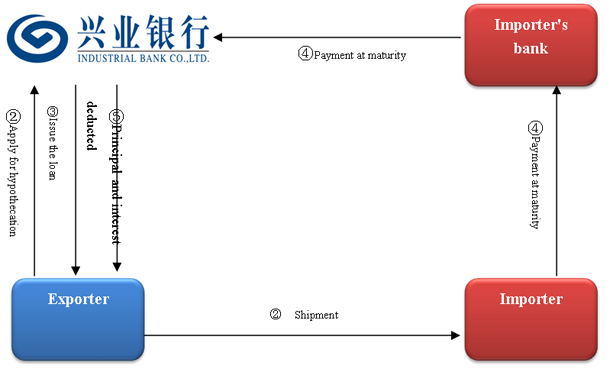

(II) Export Hypothecation

1. Product Definition

Export hypothecation: upon application from the exporter, after he or she submits full package of export bills, trade contract and relevant export certificates, the Bank provides the exporter with short term funds accommodation with recourse, and uses the inward foreign exchange from export as the first source of repayment.

2. Service Types

There are three types under export hypothecation, namely documentary L/C, documentary collection and export hypothecation under inward remittance.

3. Service Advantages

(1) Accelerate capital turnover and achieve earlier receipt of remittance;

(2) Simplify financing procedure, and lower financing cost;

(3) Settle foreign exchange in advance and avoid risk in exchange rate;

4. Applicable Scope

The exporters that need to avoid risk in foreign exchange settlement and to accelerate capital turnover.

5. Business Procedures

(1) The exporter insures with SINOSURE which will evaluate credit line for the exporter;

(2) The Bank, the exporter and SINOSURE sign Agreement on Transfer Indemnity Rights

(3) The exporter submits documents after shipment, and applies for export hypothecation;

(4) The Bank approves and extends the loan;

(5) The importer pays at maturity;

(6) The Bank transfers the balance after deducting the principal and interest of loan into customer’s account.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

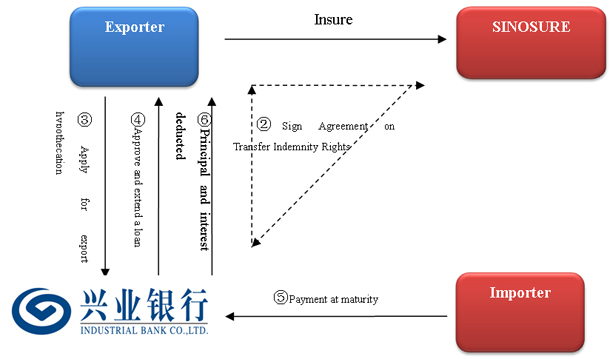

(III) Export Credit Insurance Hypothecation

1. Product Definition

Export credit insurance hypothecation: under the premise that the exporter has insured short term export credit insurance with SINOSURE and its branches and transferred its indemnity rights under such policies to the Bank, the Bank, based on a certain percentage to the value of goods shipped, provides it with short term funds accommodation with recourse, and uses the inward foreign exchange from export as the source of repayment.

2. Service Types

There are three types of export credit insurance hypothecation, namely, documentary L/C, documentary collection (D/P, D/A) and inward remittance (OA) credit insurance hypothecation.

3. Service Advantages

(1) Avoid risk in receiving foreign exchange. The exporter may avoid the risk in the buyer’s commercial credit and related countries and regions;

(2) Enlarge trade opportunity. It helps the exporter to develop business in high risk area, with more favorable settlement term and enhanced competitiveness;

(3) Accelerate capital turnover and achieve earlier receipt of remittance;

(4) Settle foreign exchange in advance and avoid risk of exchange rate;

4. Applicable Scope

The exporters that need to avoid risk in receiving foreign exchange and to accelerate capital turnover.

5. Business Procedures

(1) The exporter insures with SINOSURE which will evaluate credit line for the exporter;

(2) The Bank, the exporter and SINOSURE sign Agreement on Transfer Indemnity Rights

(3) The exporter submits documents after shipment, and applies for export hypothecation;

(4) The Bank approves and extends the loan;

(5) The importer pays at maturity;

(6) The Bank transfers the balance after deducting the principal and interest of loan into customer’s account.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

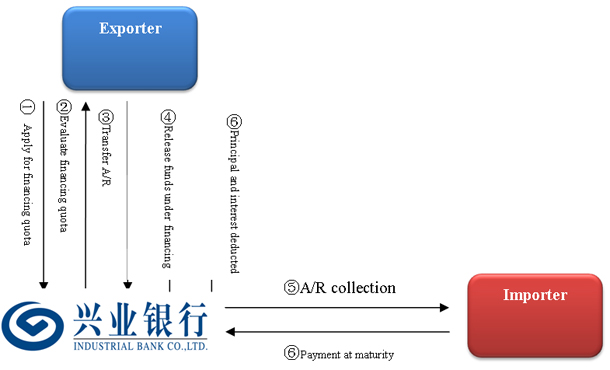

(IV) Export Bills Factoring

1. Product Definition

Export bills factoring: the exporter transfers accounts receivable to the Bank, as the export factor, the Bank provides the exporter with comprehensive financial services including collection and management of accounts receivable, trade financing with recourse etc.

2. Service Advantages

(1) Enlarge trade opportunity. The exporter may provide the importer with more competitive credit sales and payment term of documents against acceptance, thus expanding overseas market and increasing trade opportunity;

(2) Obtain financing without additional guarantee from the exporter;

(3) Save resources in sales account and accounts management for exporter;

3. Applicable Scope

The exporters that settle with credit sales or documents against acceptance, have regular trade contacts, maintain stable trade relation the buyers, own qualified accounts receivable recognized by the Bank and need to vitalize accounts receivable under export business.

4. Business Procedures

(1) The exporter applies to the Bank for financing quota under export bills factoring;

(2) The Bank evaluates financing quota for and signs Agreement on Factoring of Bills with Recourse with the exporter;

(3) The exporter transfers its accounts receivable to the Bank;

(4) The Bank releases funds under financing to the exporter;

(5) The Bank presents for payment by the importer, and regularly calls on due but unpaid accounts receivable;

(6) The importer pays at maturity, and the Bank transfers the balance after deducting the principal and interest to the exporter.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(V) Export Two-factor

1. Product Definition

Export two-factor: the exporter transfers its accounts receivable resulting from its trade with the importers to the Bank, and the Bank provides the exporter with comprehensive financial service including management and collection of accounts receivable, protection against the buyer's bad debts and trade financing.

2. Service Types

There are export two-factors with recourse and without recourse.

3. Service Advantages

(1) Enlarge trade opportunity. The exporter may provide the importer with more competitive credit sales and payment term of documents against acceptance, thus expanding overseas market and increasing trade opportunity;

(2) Obtain financing without additional guarantee from the exporter;

(3) Buy-out financing reduce risk in receiving foreign exchange. Under export two-factor without recourse, the Bank bears the credit risk of the importer, and the exporter will have full protection of receiving foreign exchange;

(4) Receive foreign exchange in advance and avoid risk of exchange rate;

(5) Earlier cancel after verification for tax refund, thus beautifying the financial statement.

4. Applicable Scope

The exporters and importers that settle with credit sales or documents against acceptance, have regular trade contacts, maintain stable trade relation the buyers, own qualified accounts receivable recognized by the Bank and need to vitalize accounts receivable under export business.

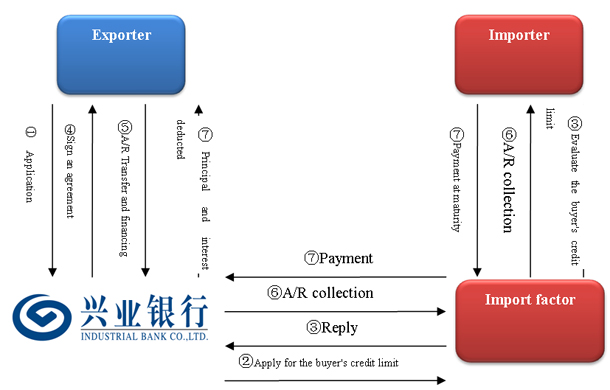

5. Business Procedures

(1) The exporter applies to the Bank for export two-factor;

(2) The Bank applies for the buyer's credit limit from the import factor;

(3) The import factor evaluates the buyer’s credit limit and replies to the Bank;

(2) The Bank evaluates financing quota for and signs Agreement on Export Two-Factor with the exporter;

(5) The exporter transfers its accounts receivable to the Bank, and the Bank releases funds under financing to the exporter;

(6) The import factor collects payable but unpaid accounts receivable;

(7) The importer pays upon expiration, and the Bank transfers the balance after deducting the principal and interest to the exporter.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(VI) Export Order Financing

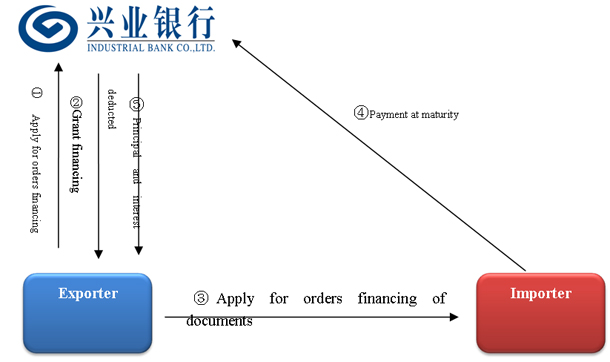

I. Product Profile

Upon request by the exporter, the Bank, based on valid trade orders between the exporter and the importer, provides the exporter with short term trade financing with pledge of future accounts receivable, and the funds under financing will be used mainly for procurement, production, storage and transportation of export goods.

II. Product Features

(1) It provides the exporter with funds accommodation during production, procurement and other preparation stages, reduces the capital tied up and improves the capital utilization efficiency for the exporter;

(2) When the exporter is short in funds and cannot obtain the term of advance payment, it helps the exporter to conduct business and grasp business opportunity.

III. Target Customers

Target Customers Exporters that settle by consignment collection and T/T and have financing demand before the shipment of goods.

IV. Business Procedures (the exporter - the applicant for financing)

(1) After the Bank evaluates credit limit of export order financing, the customer applies for financing according to the condition of specific order, and necessary materials include:

(2) The Bank approves application materials and grants export financing.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(VII) Export Tax Rebate Pledged Financing

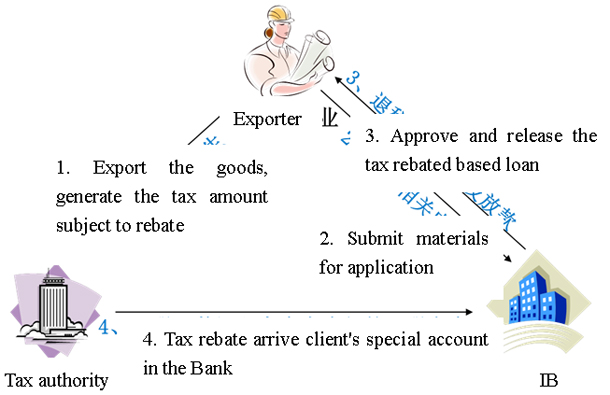

1. Product Profile

To solve short term capital difficulties caused by delayed export tax rebate of exporters, on the premise of managing the enterprise’s export tax rebate account in trust, the Bank provides short-term working capital loan pledged by receivables under tax rebate to the export enterprise.

2. Product Features

Relieve capital pressure due to delayed tax rebate and improve the financial condition for customers;

Simple application procedure, lower requirement for guarantee.

3. Target Customers

The exporters that have tax rebate qualification, long waiting time for tax rebate and financing needs.

4. Business Procedures

The below chart explains the overall procedures of conducting export tax rebate special account pledged loan.

(1) The customer submits application for export tax rebate special account pledged loan to the Bank, as well as necessary materials including declaration details of export tax rebate, VAT invoice etc.

(2) The Bank reviews materials submitted by the borrower, verifies and confirms the tax amount subject to rebate, and approves the loan.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

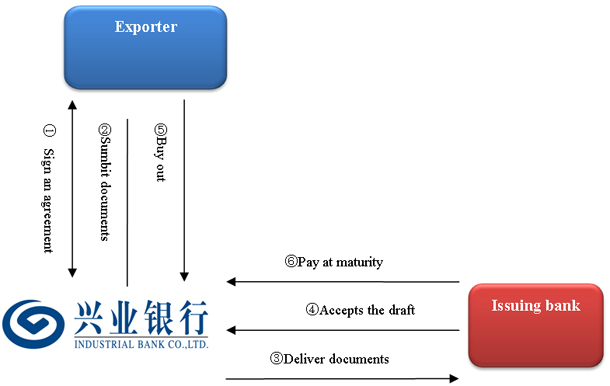

(VIII) Forfeiting

1. Product Definition

Forfeiting: the Bank, as the forfeiter, buys drafts/bonds accepted/honored or guaranteed by banks from the exporter without recourse.

2. Service Advantages

(1) No recourse. In the event that the exporter is unable to receive foreign exchange due to debtor's risk or state risk, the Bank will not exercise recourse against the exporter;

(2) Receive foreign exchange in advance and avoid risk of exchange rate;

(3) Earlier cancel after verification for tax refund, thus beautifying the financial statement.

3. Applicable Scope

Exporters that have import and export operation right, sound credit standing, wish to receive foreign exchange earlier and enjoy tax rebate, have capital turnover problem temporarily, and engage in merchandise trade such as electromechanical and equipments.

4. Business Procedures

(1) The exporter signs forfeiting agreement with the Bank and then applies case by case;

(2) The exporter submits documents to the Bank first;

(3) The Bank sends documents to issuing bank;

(4) The issuing bank accepts the draft;

(5) The Bank pays considerations to the exporter to buy out the bills;

(6) The issuing bank pays the Bank at maturity.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(IX) Import Goods Control Financing

1. Product Profile

Upon application by our import customer (“applicant”), based on effective control of future property in goods under letter of credit, the Bank waives part of deposits for issuance of L/C.

2. Product Features

1. Pledged with future property in goods, the customer needs no additional guarantee except for payment of partial issuing deposits, thus resolving the problem of financing guarantee for import clients.

2. By obtaining financing via import goods control issuance, the importer can reduce capital tie up, promote sales of products, accelerate capital turnover and optimize financial structure.

3. Target Customers

1. Import customers that have insufficient guarantee, settle with L/C and wish to reduce deposits for issuance of L/C

2. The goods imported must comply with the requirements in the Bank’s product category of goods pledge.

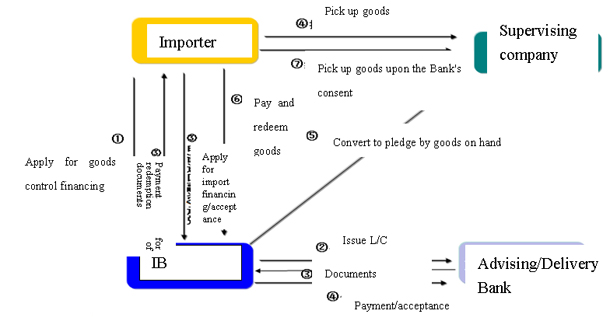

4. Business Procedures (see below chart for the overall procedures of import goods control financing)

The major procedures for conducting import goods control financing by the customer (importer) in the Bank:

(1) The importer applies to the Bank for credit extension and obtains special quota for import goods control financing;

(2) The Bank reviews the application and issues L/C.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(X) Guarantee for Delivery

1. Product Definition

Guarantee for delivery: when the goods under documentary L/C arrive the destination before original bill of lading, the importer (applicant) may request the Bank to issue a Guarantee for Delivery for it and take delivery from the shipping company with the guarantee.

2. Service Advantages

(1) Take delivery timely, avoid demurrage effectively;

(2) It helps the importer to pick up goods, declare at customs, sell and achieve revenue in advance, thus accelerating capital turnover and reduce capital tied up for the importer.

3. Applicable Scope

The importers that need to pick up goods before the bill of lading arrives so to avoid demurrage, accelerate capital turnover and reduce capital tied up.

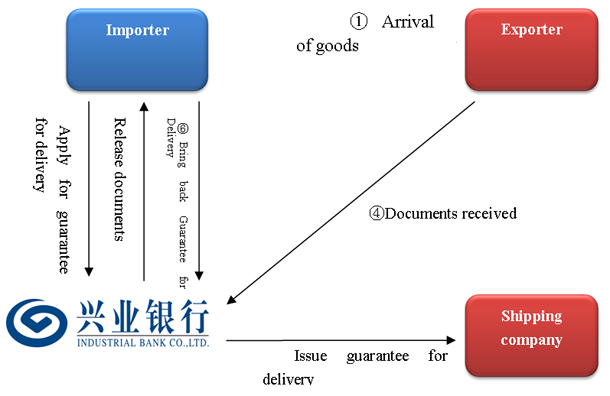

4. Business Procedures

(1) The goods arrive before the bill of lading;

(2) The importer submits materials to the Bank to apply for Guarantee for Delivery;

(3) The Bank reviews and approves the application, and issues Guarantee for Delivery to shipping company, and the importer can take delivery with the guarantee;

(4) The Bank receives documents under L/C;

(5) The importer pays or accepts, and the Bank releases documents to it;

(6) The importer uses original bill of lading to bring back Guarantee for Delivery from the shipping company, and returns it to the Bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(XI) Import Hypothecation

1. Product Definition

Import hypothecation: upon application by the importer, on the premises that the importer submits receipt of trust and related certificate of import, the Bank provides it with short term funds accommodation for making the payment for goods, and uses the sales incomes as the primary source for repayment within a specified period.

2. Service Types

There are import L/C, import consignment collection and hypothecation under outward remittance.

3. Service Advantages

(1) Less capital tied up. By import hypothecation, the importer can conduct import and domestic sales of goods with financing from bank, and use no or less self-owned funds to finish the trade and earn revenue;

(2) Seize the market opportunity. When the importer is unable to pay and pick up goods due to short of capital temporarily, import hypothecation enables it to pick up and sells goods when the self-owned funds is insufficient, thus seizing the market opportunity.

4. Applicable Scope

The importers that need to vitalize funds, reduce capital tie up, pick up and sell goods in a timely manner.

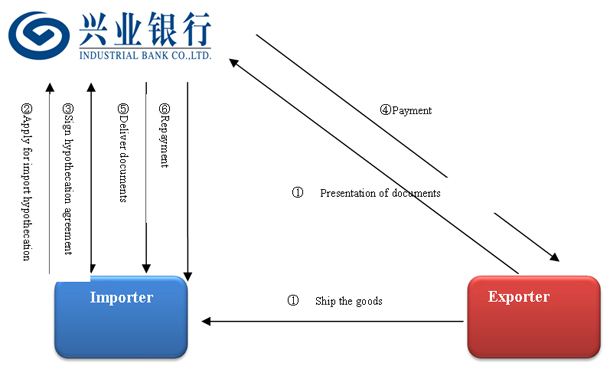

5. Business Procedures

(1) The exporter ships the goods and presents documents to the Bank;

(2) The importer applies to the Bank for import hypothecation;

(3) The importer signs hypothecation agreement with the Bank;

(4) The Bank makes the payment under hypothecation to the exporter on behalf of the importer;

(5) The Bank delivers the documents to the importer;

(6) The importer pays the Bank at maturity to repay the payment under hypothecation.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

(XII) Import Factoring

1. Product Definition

Import factoring: upon the application by the export factor or the export, the Bank, as the import factor, evaluates the buyer’s credit line for a particular importer, and provides the export factor or the export with services including credit inquiry, A/R management, A/R collection and guarantee for bad debts.

2、Service Types

Credit inquiry of importers, collection and consignment collection of A/R and guarantee for bad debts.

3. Service Advantages

(1) Reduce transaction cost. Replace L/C settlement with credit sales, save charges for issuing L/C;

(2) Stabilize trade relationship between the buyer and the seller. The presence of bank credit facilitates the trade and maintains relationship between the two parties;

(3) Avoid performance risk from the exporter. The importer inspects and makes payment after the arrival of goods, thus avoiding the fraud and/or performance risk from the exporter under L/C.

4. Applicable Scope

The importers that settle with credit sales or documents against acceptance and have financing needs.

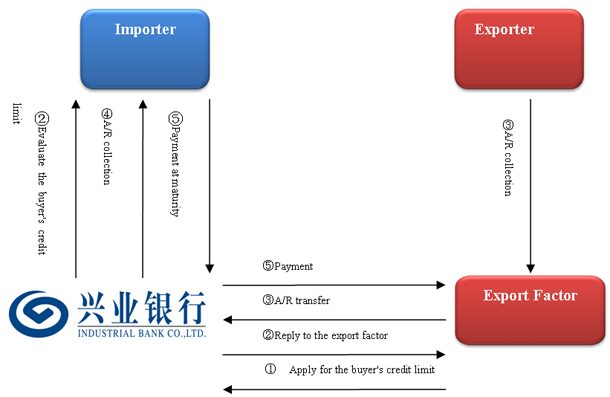

5. Business Procedures

(1) The export factor applies for the buyer’s credit limit to the Bank;

(2) The Bank evaluates the buyer’s credit limit for the importer, and replies to the export factor;

(3) The exporter transfers A/R to the export factor who then transfers it to the Bank;

(4) The Bank presents documents for payment by the importer and makes the collection;

(5) The importer makes the payment at maturity, and the Bank pays to the export factor.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

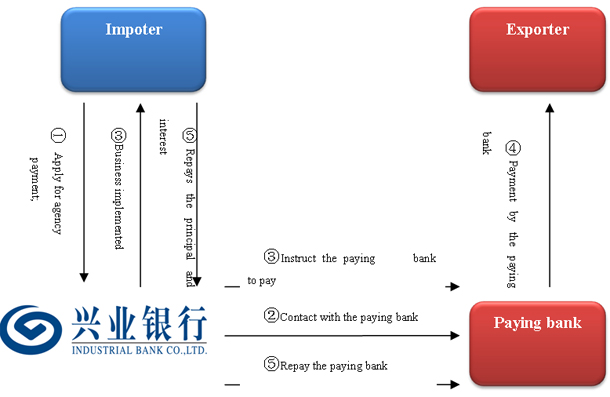

(XIII) Import Agency Payment

1. Product Definition

Import agency payment: upon application by the importer, based on financing agreement with the corresponding bank, the Bank instructs the correspond bank to pay to the payee, and the Bank repays the agency payment at and on agreed interest rate and deadline.

2. Service Types

Import agency payment under L/C, import agency payment under consignment collection, and import agency payment under outward remittance.

3. Service Advantages

(1) Less capital tied up. By import agency payment, the importer can conduct import and domestic sales of goods with financing from bank, and use no or less self-owned funds to finish the trade and earn revenue;

(2) Reduce financing cost for customer. Because of using financing from the correspondent bank, the financing cost of import agency payment is usually lower, and the importer can enjoy interest rate of financing lower than import hypothecation, thus saving financial cost.

4. Applicable Scope

Same with import hypothecation.

5. Business Procedures

(1) The importer submits materials to apply for import agency payment;

(2) The Bank contacts with the paying bank and makes an offer to the customer;

(3) The business implemented, and the Bank instructs the paying bank to pay;

(4) The paying bank makes the payment to the exporter;

(5) Upon expiration of the financing, the importer repays the principal and interest, and the Bank repays the paying bank.

Please call our customer service hotline 95561 or contact local branches to conduct this business, and you will be reached by our staff.

TOP