Bills

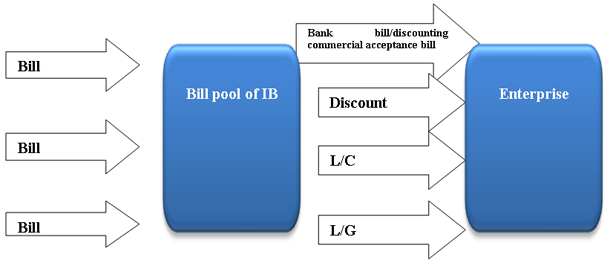

(I) Bill Pool

1. Product Definition

Bill pool: in respect of maturity mismatch and amount mismatch at receipt and payment of bills in purchases and sales for enterprises and use its internal bill pool in a planner manner, the Bank provide enterprises with a package of settlement and credit extension services such as bill custody, bill pool pledge-based credit extension and buy-out of bill pool.

2. Service Types

Include bill custody, bill pool pledge-based credit extension, bill group of corporate group and buy-out of bill pool

3. Service Advantages

(1) The customer outsources unfamiliar works such as bill identification and refuses to store real object, thus reducing unnecessary workload and increase efficiency by division of work;

(2) With bill custody, the customer may conduct withdraw, discount and pledge based issuance (loan), thus increasing capital operation efficiency;

(3) The Bank help the customer manage bill resources in a refined way and obtain value added services for bill at maximum, so as to leverage the huge time value of bill.

4. Applicable Scope

Suitable to customers with large amount of bills but without discount demand temporarily, it helps them lower the workload in processing bill and manage bill resources effectively.

5. Business Procedures

(1) The Bank signs relevant agreement about bill pool with customers;

(2) The customer delivers the bills, and the Bank conducts the identification, inquiry and storage of bill as agreed;

(3) The Bank provides services such as bill custody, bill pool pledge-based credit extension and buy-out of bill pool under credit line.

Please call our customer service hotline 95561 or contact local branches to conduct bill pool financing, and you will be reached by our staff.

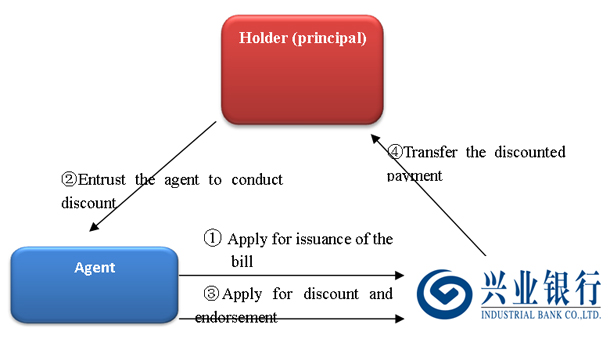

(II) Agency Discount Bills

1. Product Definition

Agency discount bills: the Bank signs tripartite agreement with the holder (the principal) of commercial bills and its agent, and the holder entrusts its agent to conduct discount on bills at banks on its behalf, and the Bank, after confirmation, transfers the discounted payment to the relevant account of the holder.

2. Service Advantages

(1) Process the seller’s non-local bills at local level;

(2) Reduce the circulation link of bills, and the seller may accelerate the capital recovery;

(3) The buyer may control financing cost, and receive discount on cash payment.

3. Applicable Scope

Non-local holders of bills who are not convenient to operate discount.

4. Business Procedures

(1) The agent applies for issuing the bills;

(2) The holder (the principal) entrusts the agent to conduct discount;

(3) The agent conducts discount and endorsement with the Bank;

(4) The Bank transfers the discounted payment to the relevant account of the principal.

Please call our customer service hotline 95561 or contact local branches to conduct agency discount bills, and you will be reached by our staff.

(III) Bill for Bill

1. Product Definition

Bill for bill: due to trade or working capital demand, the customer pledges its legally owned one or more bank acceptance bill(s) and applies to the Bank for issuing one or more bank acceptance bill(s).

2. Service Advantages

(1) Issue whenever needed with simple procedure;

(2) Flexible conversion between fractional and integral bills, long term and short term bills, and vitalize bills resources;

(3) Save interest expense on discount and financial cost.

3. Applicable Scope

Customers who use bank acceptance bills as the primary settlement method.

Please call our customer service hotline 95561 or contact local branches to conduct bill for bill, and you will be reached by our staff.

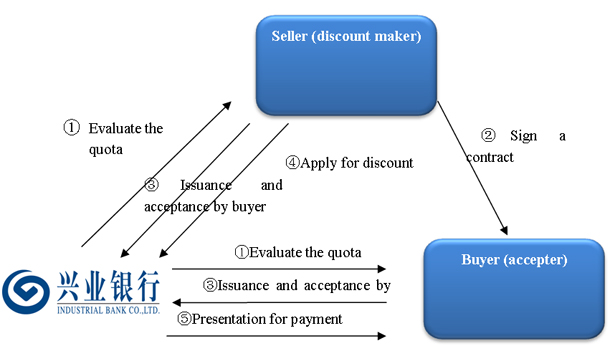

(IV) Commercial Acceptance Bill Discounting

1. Product Definition

Commercial acceptance bill discounting: for commercial acceptance bill accepted by specific accepter or held by specific discount applicant, the Bank promise to discount at agreed discount rate under credit line and certain period.

2. Service Advantages

(1) Combine bank credit and enterprise credit, increase the credit level and negotiability of commercial acceptance notes;

(2) Closed operation, reduce risks;

(3) Lower cost of commercial acceptance notes helps to save financial cost;

(4) Enhanced credit level of commercial acceptance notes helps improve the market position of customers.

3. Applicable Scope

Customers who use commercial acceptance notes as the primary settlement method.

4. Business Procedures

(1) The seller/buyer applies for the quota of discounting, and the Bank evaluates the quota;

(2) The buyer and the seller conclude and sign Purchase and Sales Contract;

(3) The buyer buys blank commercial acceptance bills from the Bank for issuance and acceptance by itself;

(4) The seller applies for discount from the Bank as agreed in the agreement, and the Bank accepts the application based on relevant procedure;

(5) The Bank presents for payment by the accepter upon maturity of acceptance bill.

Please call our customer service hotline 95561 or contact local branches to conduct commercial acceptance bill discounting, and you will be reached by our staff.

TOP